It is recommended to use the CppDepend interactive UI capabilities

to make the most of CppDepend by mastering all aspects of your code.

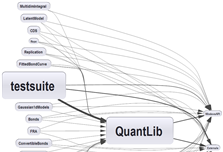

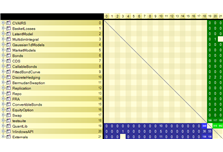

Diagrams

Application Metrics

Note: Further Application Statistics are available.

|

Quality Gates summary

803 Some Quality Gates fail. The build

Some Quality Gates fail. The buildcan be stopped upon quality gate

failure. Online documentation.

Quality Gates that measure diff cannot

Quality Gates that measure diff cannotbe run on the baseline. Hence they

have blank trend and baseline status.

| Name | Trend | Baseline Value | Value | Group | |||

|---|---|---|---|---|---|---|---|

| Project Rules \ Quality Gates | ||||||

| Project Rules \ Quality Gates | ||||||

| Project Rules \ Quality Gates | ||||||

| Project Rules \ Quality Gates | ||||||

| Project Rules \ Quality Gates | ||||||

| Project Rules \ Quality Gates | ||||||

| Project Rules \ Quality Gates | ||||||

| Project Rules \ Quality Gates | ||||||

| Project Rules \ Quality Gates | ||||||

| Project Rules \ Quality Gates | ||||||

| Project Rules \ Quality Gates |

Rules summary

247253- Number of Rules or Queries with Error (syntax error, exception thrown, time-out): 0

- Number of Rules violated: 28

Rules can be checked from within

Rules can be checked from withinVisualCppDepend.

Online documentation.

Rules that rely on diff cannot be

Rules that rely on diff cannot berun on the baseline. Hence they

have blank # Issues Fixed or Added.

| Name | # Issues | Added | Fixed | Elements | Group | |||

|---|---|---|---|---|---|---|---|---|

| 20 | 0 | 0 | types | Project Rules \ Code Smells | |||

| 31 | 0 | 0 | types | Project Rules \ Code Smells | |||

| 54 | 0 | 0 | types | Project Rules \ Code Smells | |||

| 311 | 0 | 0 | methods | Project Rules \ Code Smells | |||

| 181 | 0 | 0 | methods | Project Rules \ Code Smells | |||

| 414 | 0 | 0 | methods | Project Rules \ Code Smells | |||

| 141 | 0 | 0 | methods | Project Rules \ Code Smells | |||

| 433 | 0 | 0 | methods | Project Rules \ Code Smells | |||

| 48 | 0 | 0 | types | Project Rules \ Code Smells | |||

| 351 | 0 | 0 | types | Project Rules \ Object Oriented Design | |||

| 9 | 0 | 0 | methods | Project Rules \ Object Oriented Design | |||

| 14 | 0 | 0 | fields | Project Rules \ Object Oriented Design | |||

| 38 | 0 | 0 | types | Project Rules \ Object Oriented Design | |||

| 287 | 0 | 0 | types | Project Rules \ Object Oriented Design | |||

| 1 | 0 | 0 | project | Project Rules \ Object Oriented Design | |||

| 87 | 0 | 0 | types | Project Rules \ Object Oriented Design | |||

| 12 | 0 | 0 | methods | Project Rules \ CWE Rules | |||

| 609 | 0 | 0 | types | Project Rules \ Dead Code | |||

| 507 | 0 | 0 | methods | Project Rules \ Dead Code | |||

| 918 | 0 | 0 | fields | Project Rules \ Dead Code | |||

| 10 | 0 | 0 | fields | Project Rules \ Naming Conventions | |||

| 10 | 0 | 0 | fields | Project Rules \ Naming Conventions | |||

| 2 | 0 | 0 | types | Project Rules \ Naming Conventions | |||

| 10 | 0 | 0 | types | Project Rules \ Naming Conventions | |||

| 38 | 0 | 0 | types | Project Rules \ Naming Conventions | |||

| 146 | 0 | 0 | methods | Project Rules \ Naming Conventions | |||

| 13 | 0 | 0 | fields | Project Rules \ Naming Conventions | |||

| 1 | 0 | 0 | type | Project Rules \ Naming Conventions |

Application Statistics

| Stat | # Occurences | Avg | StdDev | Max |

|---|---|---|---|---|

| Properties on interfaces | interfaces | 0 | 0 | -1 properties on |

| Methods on interfaces | interfaces | 0 | 0 | -1 methods on |

| Arguments on methods on interfaces | methods | 0 | 0 | -1 arguments on |

| Public properties on classes | 1,896 Classes | 0 | 0 | 0 public properties on Keywords |

| Public methods on classes | 1,896 classes | 6.57 | 7.34 | 225 public methods on QuantLib.__Globals |

| Arguments on public methods on classes | 12,450 methods | 1.05 | 1.5 | 20 arguments on QuantLib.FixedRateBond.FixedRateBond(Natural,constQuantLib::Calendar&,Real,constQuantLib::Date&,constQuantLib::Date&,constQuantLib::Period&,conststd::vector<Rate>&,constQuantLib::DayCounter&,QuantLib::BusinessDayConvention,QuantLib::BusinessDayConvention,Real,constQuantLib::Date&,constQuantLib::Date&,DateGeneration::Rule,bool,constQuantLib::Calendar&,constQuantLib::Period&,constQuantLib::Calendar&,constQuantLib::BusinessDayConvention,bool) |

| IL instructions in non-abstract methods | 13,971 methods | 0.15 | 0.61 | 11 IL instructions in JumpDiffusionTest.testGreeks() |

| Cyclomatic complexity on non abstract Methods | 13,971 Methods | 0.64 | 3.12 | CC = 123 for DateTest.immDates() |

Projects Metrics

Clicking column header arrows sorts values.

Clicking column header title text redirect to the online Code Metric definition.

| Projects | # lines of code | # IL instruction | # Types | # Abstract Types | # lines of comment | % Comment | % Coverage | Afferent Coupling | Efferent Coupling | Relational Cohesion | Instability | Abstractness | Distance |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| QuantLib v1.0.0.0 | 32222 | 1107 | 1749 | 91 | 18973 | 37,06026 | - | 255 | 194 | 2.28 | 0.43 | 0.05 | 0.36 |

| testsuite v1.0.0.0 | 21676 | 1014 | 304 | 0 | 3859 | 15,11259 | - | 0 | 531 | 0.47 | 1 | 0 | 0 |

| Swap v1.0.0.0 | 209 | 0 | 0 | 0 | 66 | 24 | - | 0 | 27 | 0.33 | 1 | 0 | 0 |

| EquityOption v1.0.0.0 | 76 | 1 | 0 | 0 | 25 | 24,75248 | - | 0 | 15 | 0.33 | 1 | 0 | 0 |

| ConvertibleBonds v1.0.0.0 | 87 | 3 | 0 | 0 | 7 | 7,446808 | - | 0 | 20 | 0.33 | 1 | 0 | 0 |

| FRA v1.0.0.0 | 96 | 1 | 0 | 0 | 28 | 22,58064 | - | 0 | 14 | 0.33 | 1 | 0 | 0 |

| Repo v1.0.0.0 | 55 | 0 | 0 | 0 | 20 | 26,66667 | - | 0 | 21 | 0.33 | 1 | 0 | 0 |

| Replication v1.0.0.0 | 106 | 1 | 0 | 0 | 34 | 24,28572 | - | 0 | 14 | 0.33 | 1 | 0 | 0 |

| BermudanSwaption v1.0.0.0 | 71 | 2 | 0 | 0 | 17 | 19,31818 | - | 0 | 23 | 0.33 | 1 | 0 | 0 |

| DiscreteHedging v1.0.0.0 | 115 | 1 | 2 | 0 | 73 | 38,82979 | - | 0 | 27 | 0.4 | 1 | 0 | 0 |

| FittedBondCurve v1.0.0.0 | 141 | 3 | 0 | 0 | 34 | 19,42857 | - | 0 | 24 | 0.33 | 1 | 0 | 0 |

| CallableBonds v1.0.0.0 | 94 | 1 | 0 | 0 | 23 | 19,65812 | - | 0 | 25 | 0.33 | 1 | 0 | 0 |

| CDS v1.0.0.0 | 60 | 1 | 0 | 0 | 15 | 20 | - | 0 | 17 | 0.33 | 1 | 0 | 0 |

| Bonds v1.0.0.0 | 88 | 1 | 0 | 0 | 89 | 50,28249 | - | 0 | 28 | 0.33 | 1 | 0 | 0 |

| MarketModels v1.0.0.0 | 259 | 6 | 0 | 0 | 60 | 18,80878 | - | 0 | 33 | 0.33 | 1 | 0 | 0 |

| Gaussian1dModels v1.0.0.0 | 177 | 3 | 1 | 0 | 10 | 5,347594 | - | 0 | 20 | 0.5 | 1 | 0 | 0 |

| MultidimIntegral v1.0.0.0 | 22 | 1 | 1 | 0 | 9 | 29,03226 | - | 0 | 3 | 0.25 | 1 | 0 | 0 |

| LatentModel v1.0.0.0 | 76 | 2 | 0 | 0 | 50 | 39,68254 | - | 0 | 16 | 0.33 | 1 | 0 | 0 |

| BasketLosses v1.0.0.0 | 81 | 1 | 0 | 0 | 44 | 35,2 | - | 0 | 16 | 0.33 | 1 | 0 | 0 |

| CVAIRS v1.0.0.0 | 69 | 1 | 0 | 0 | 24 | 25,80645 | - | 0 | 19 | 0.33 | 1 | 0 | 0 |

Types Metrics

If the code base analyzed has too many types, CppDepend doesn't list Types Metrics to avoid a too big report. The section Types Metrics can be activated by unchecking the option: CppDepend Project Properties > Report > Avoid too big report for large code base > Hide section Types Metrics if... It is recommended to use the CppDepend interactive UI capabilities to browse large applications. |

Namespaces Metrics

Clicking column header arrows sorts values.

Clicking column header title text redirect to the online Code Metric definition.

| Namespaces | # lines of code | # IL instruction | # Types | # lines of comment | % Comment | % Coverage | Afferent Coupling | Efferent Coupling |

|---|---|---|---|---|---|---|---|---|

| QuantLib::GlobalNamespace | 285 | 9 | 0 | 0 | 0 | - | 0 | 6 |

| QuantLib::QuantLib | 28446 | 970 | 1649 | 0 | 0 | - | 149 | 17 |

| QuantLib::QuantLib.MINPACK | 348 | 11 | 0 | 0 | 0 | - | 0 | 0 |

| QuantLib::QuantLib .ForwardForwardMappings | 45 | 5 | 0 | 0 | 0 | - | 0 | 3 |

| QuantLib::QuantLib.io | 16 | 0 | 0 | 0 | 0 | - | 0 | 2 |

| QuantLib::QuantLib .anonymous_namespace{hestonrndcalculator .cpp} | 23 | 0 | 2 | 0 | 0 | - | 0 | 2 |

| QuantLib::QuantLib .anonymous_namespace{hestonslvfdmmodel .cpp} | 16 | 1 | 2 | 0 | 0 | - | 0 | 2 |

| QuantLib::QuantLib .anonymous_namespace{dynprogvppintrinsic valueengine.cpp} | 12 | 0 | 2 | 0 | 0 | - | 0 | 3 |

| QuantLib::QuantLib .anonymous_namespace{fdsimpleextoustorag eengine.cpp} | 5 | 0 | 2 | 0 | 0 | - | 1 | 2 |

| QuantLib::QuantLib .anonymous_namespace{fdsimpleklugeextouv ppengine.cpp} | 2 | 0 | 1 | 0 | 0 | - | 0 | 2 |

| QuantLib::QuantLib .anonymous_namespace{vanillavppoption .cpp} | 3 | 0 | 1 | 0 | 0 | - | 0 | 2 |

| QuantLib::QuantLib .anonymous_namespace{vanillaswingoption .cpp} | 12 | 1 | 0 | 0 | 0 | - | 0 | 2 |

| QuantLib::QuantLib .anonymous_namespace{differentialevoluti on.cpp} | 1 | 0 | 1 | 0 | 0 | - | 0 | 1 |

| QuantLib::QuantLib .anonymous_namespace{richardsonextrapola tion.cpp} | 6 | 0 | 1 | 0 | 0 | - | 1 | 0 |

| QuantLib::QuantLib .anonymous_namespace{concentrating1dmesh er.cpp} | 7 | 1 | 1 | 0 | 0 | - | 0 | 2 |

| QuantLib::QuantLib .anonymous_namespace{fdmmeshercomposite .cpp} | 0 | 0 | 0 | 0 | 0 | - | 0 | 0 |

| QuantLib::QuantLib .anonymous_namespace{lsmbasissystem.cpp} | 24 | 4 | 2 | 0 | 0 | - | 0 | 2 |

| QuantLib::QuantLib .anonymous_namespace{parametricexercise .cpp} | 20 | 2 | 1 | 0 | 0 | - | 1 | 3 |

| QuantLib::QuantLib .anonymous_namespace{averagebmacoupon .cpp} | 26 | 1 | 1 | 0 | 0 | - | 0 | 2 |

| QuantLib::QuantLib .anonymous_namespace{cashflows.cpp} | 108 | 4 | 4 | 0 | 0 | - | 0 | 3 |

| QuantLib::QuantLib.detail | 463 | 23 | 25 | 0 | 0 | - | 3 | 4 |

| QuantLib::QuantLib.detail.NoArbSabrModel | 0 | 0 | 0 | 0 | 0 | - | 0 | 0 |

| QuantLib::QuantLib .anonymous_namespace{conundrumpricer .cpp} | 9 | 1 | 2 | 0 | 0 | - | 1 | 1 |

| QuantLib::QuantLib .anonymous_namespace{couponpricer.cpp} | 0 | 0 | 1 | 0 | 0 | - | 0 | 2 |

| QuantLib::QuantLib .anonymous_namespace{overnightindexedcou pon.cpp} | 37 | 1 | 1 | 0 | 0 | - | 0 | 3 |

| QuantLib::QuantLib .anonymous_namespace{bmaindex.cpp} | 6 | 0 | 0 | 0 | 0 | - | 0 | 1 |

| QuantLib::QuantLib .anonymous_namespace{euribor.cpp} | 18 | 0 | 0 | 0 | 0 | - | 0 | 2 |

| QuantLib::QuantLib .anonymous_namespace{eurlibor.cpp} | 18 | 0 | 0 | 0 | 0 | - | 0 | 2 |

| QuantLib::QuantLib .anonymous_namespace{libor.cpp} | 18 | 0 | 0 | 0 | 0 | - | 0 | 2 |

| QuantLib::QuantLib .anonymous_namespace{shibor.cpp} | 9 | 0 | 0 | 0 | 0 | - | 0 | 2 |

| QuantLib::QuantLib .anonymous_namespace{capfloor.cpp} | 14 | 0 | 1 | 0 | 0 | - | 1 | 3 |

| QuantLib::QuantLib .anonymous_namespace{creditdefaultswap .cpp} | 7 | 0 | 1 | 0 | 0 | - | 1 | 2 |

| QuantLib::QuantLib .anonymous_namespace{impliedvolatility .cpp} | 9 | 0 | 1 | 0 | 0 | - | 1 | 2 |

| QuantLib::QuantLib .anonymous_namespace{swaption.cpp} | 14 | 0 | 1 | 0 | 0 | - | 1 | 3 |

| QuantLib::QuantLib .anonymous_namespace{factorial.cpp} | 0 | 0 | 0 | 0 | 0 | - | 0 | 0 |

| QuantLib::QuantLib .anonymous_namespace{modifiedbessel.cpp} | 28 | 2 | 5 | 0 | 0 | - | 0 | 2 |

| QuantLib::QuantLib .anonymous_namespace{primenumbers.cpp} | 0 | 0 | 0 | 0 | 0 | - | 0 | 0 |

| QuantLib::QuantLib .anonymous_namespace{histogram.cpp} | 16 | 0 | 0 | 0 | 0 | - | 0 | 1 |

| QuantLib::QuantLib .anonymous_namespace{bivariatenormaldist ribution.cpp} | 18 | 0 | 2 | 0 | 0 | - | 1 | 0 |

| QuantLib::QuantLib .anonymous_namespace{bivariatestudenttdi stribution.cpp} | 81 | 1 | 0 | 0 | 0 | - | 0 | 0 |

| QuantLib::QuantLib .anonymous_namespace{basisincompleteorde red.cpp} | 9 | 2 | 0 | 0 | 0 | - | 0 | 1 |

| QuantLib::QuantLib .anonymous_namespace{pseudosqrt.cpp} | 186 | 16 | 1 | 0 | 0 | - | 0 | 3 |

| QuantLib::QuantLib .anonymous_namespace{svd.cpp} | 5 | 0 | 0 | 0 | 0 | - | 0 | 0 |

| QuantLib::QuantLib .anonymous_namespace{latticerules.cpp} | 0 | 0 | 0 | 0 | 0 | - | 0 | 0 |

| QuantLib::QuantLib .anonymous_namespace{sobolrsg.cpp} | 0 | 0 | 0 | 0 | 0 | - | 0 | 0 |

| QuantLib::QuantLib .anonymous_namespace{simplex.cpp} | 9 | 1 | 0 | 0 | 0 | - | 0 | 2 |

| QuantLib::QuantLib .anonymous_namespace{spherecylinder.cpp} | 27 | 1 | 0 | 0 | 0 | - | 0 | 0 |

| QuantLib::QuantLib .anonymous_namespace{sobolbrowniangenera tor.cpp} | 25 | 5 | 0 | 0 | 0 | - | 0 | 1 |

| QuantLib::QuantLib .anonymous_namespace{alphafinder.cpp} | 80 | 1 | 0 | 0 | 0 | - | 0 | 0 |

| QuantLib::QuantLib .anonymous_namespace{capletcoterminalmax homogeneity.cpp} | 114 | 2 | 0 | 0 | 0 | - | 0 | 3 |

| QuantLib::QuantLib .anonymous_namespace{upperboundengine .cpp} | 22 | 2 | 1 | 0 | 0 | - | 1 | 3 |

| QuantLib::QuantLib .anonymous_namespace{swaptionpseudojacob ian.cpp} | 13 | 2 | 1 | 0 | 0 | - | 0 | 2 |

| QuantLib::QuantLib .anonymous_namespace{garch.cpp} | 167 | 4 | 6 | 0 | 0 | - | 0 | 3 |

| QuantLib::QuantLib .anonymous_namespace{fixedlocalvolsurfac e.cpp} | 11 | 1 | 0 | 0 | 0 | - | 0 | 3 |

| QuantLib::QuantLib .anonymous_namespace{hestonblackvolsurfa ce.cpp} | 1 | 0 | 0 | 0 | 0 | - | 0 | 0 |

| QuantLib::QuantLib .anonymous_namespace{yieldtermstructure .cpp} | 0 | 0 | 0 | 0 | 0 | - | 0 | 0 |

| QuantLib::QuantLib .anonymous_namespace{defaultdensitystruc ture.cpp} | 5 | 0 | 1 | 0 | 0 | - | 0 | 0 |

| QuantLib::QuantLib .anonymous_namespace{hazardratestructure .cpp} | 5 | 0 | 1 | 0 | 0 | - | 0 | 0 |

| QuantLib::QuantLib .anonymous_namespace{exchangeratemanager .cpp} | 2 | 0 | 1 | 0 | 0 | - | 0 | 1 |

| QuantLib::QuantLib .anonymous_namespace{hestonprocess.cpp} | 83 | 2 | 0 | 0 | 0 | - | 0 | 2 |

| QuantLib::QuantLib .anonymous_namespace{stulzengine.cpp} | 26 | 0 | 0 | 0 | 0 | - | 0 | 1 |

| QuantLib::QuantLib .anonymous_namespace{analyticbsmhullwhit eengine.cpp} | 4 | 0 | 1 | 0 | 0 | - | 0 | 2 |

| QuantLib::QuantLib .anonymous_namespace{analyticgjrgarcheng ine.cpp} | 2 | 0 | 0 | 0 | 0 | - | 0 | 0 |

| QuantLib::QuantLib .anonymous_namespace{analytichestonengin e.cpp} | 8 | 0 | 2 | 0 | 0 | - | 0 | 1 |

| QuantLib::QuantLib .anonymous_namespace{bjerksundstenslande ngine.cpp} | 17 | 0 | 0 | 0 | 0 | - | 0 | 2 |

| QuantLib::QuantLib .anonymous_namespace{integralengine.cpp} | 3 | 0 | 1 | 0 | 0 | - | 1 | 0 |

| QuantLib::QuantLib .anonymous_namespace{discretizedswaption .cpp} | 2 | 0 | 0 | 0 | 0 | - | 0 | 1 |

| QuantLib::QuantLib .anonymous_namespace{period.cpp} | 11 | 0 | 0 | 0 | 0 | - | 0 | 2 |

| QuantLib::QuantLib .anonymous_namespace{schedule.cpp} | 19 | 0 | 0 | 0 | 0 | - | 0 | 1 |

| QuantLib::QuantLib .anonymous_namespace{russia.cpp} | 66 | 0 | 0 | 0 | 0 | - | 0 | 1 |

| QuantLib::QuantLib .anonymous_namespace{saudiarabia.cpp} | 12 | 2 | 0 | 0 | 0 | - | 0 | 2 |

| QuantLib::QuantLib .anonymous_namespace{unitedstates.cpp} | 14 | 0 | 0 | 0 | 0 | - | 0 | 1 |

| QuantLib::QuantLib .anonymous_namespace{business252.cpp} | 13 | 1 | 0 | 0 | 0 | - | 0 | 2 |

| QuantLib::QuantLib .anonymous_namespace{simpledaycounter .cpp} | 0 | 0 | 0 | 0 | 0 | - | 0 | 1 |

| QuantLib::QuantLib .anonymous_namespace{discretizedcallable fixedratebond.cpp} | 2 | 0 | 0 | 0 | 0 | - | 0 | 0 |

| QuantLib::QuantLib .anonymous_namespace{catrisk.cpp} | 1 | 0 | 0 | 0 | 0 | - | 0 | 0 |

| QuantLib::QuantLib .anonymous_namespace{cdsoption.cpp} | 3 | 0 | 1 | 0 | 0 | - | 1 | 2 |

| QuantLib::QuantLib .anonymous_namespace{issuer.cpp} | 0 | 0 | 0 | 0 | 0 | - | 0 | 0 |

| QuantLib::QuantLib .anonymous_namespace{randomdefaultmodel .cpp} | 2 | 0 | 1 | 0 | 0 | - | 0 | 3 |

| QuantLib::QuantLib .anonymous_namespace{syntheticcdo.cpp} | 7 | 0 | 1 | 0 | 0 | - | 1 | 2 |

| QuantLib::QuantLib .anonymous_namespace{extendedornsteinuhl enbeckprocess.cpp} | 1 | 0 | 1 | 0 | 0 | - | 0 | 0 |

| QuantLib::QuantLib .anonymous_namespace{generalizedhullwhit e.cpp} | 9 | 1 | 3 | 0 | 0 | - | 0 | 3 |

| QuantLib::QuantLib .anonymous_namespace{irregularswaption .cpp} | 4 | 0 | 1 | 0 | 0 | - | 1 | 2 |

| QuantLib::QuantLib .anonymous_namespace{integralhestonvaria nceoptionengine.cpp} | 115 | 3 | 1 | 0 | 0 | - | 0 | 1 |

| QuantLib::QuantLib .anonymous_namespace{analyticvariancegam maengine.cpp} | 11 | 0 | 1 | 0 | 0 | - | 1 | 1 |

| QuantLib::QuantLib .anonymous_namespace{quantity.cpp} | 6 | 0 | 0 | 0 | 0 | - | 0 | 3 |

| QuantLib::QuantLib .anonymous_namespace{unitofmeasureconver sionmanager.cpp} | 3 | 0 | 0 | 0 | 0 | - | 0 | 1 |

| QuantLib::QuantLib .anonymous_namespace{amortizingfixedrate bond.cpp} | 49 | 2 | 0 | 0 | 0 | - | 0 | 2 |

| QuantLib::QuantLib .anonymous_namespace{arithmeticoisratehe lper.cpp} | 0 | 0 | 0 | 0 | 0 | - | 0 | 0 |

| QuantLib::QuantLib .anonymous_namespace{perturbativebarrier optionengine.cpp} | 729 | 9 | 5 | 0 | 0 | - | 0 | 0 |

| QuantLib::QuantLib .anonymous_namespace{analyticcompoundopt ionengine.cpp} | 6 | 0 | 1 | 0 | 0 | - | 0 | 0 |

| QuantLib::QuantLib .anonymous_namespace{expm.cpp} | 5 | 1 | 1 | 0 | 0 | - | 0 | 3 |

| QuantLib::QuantLib .anonymous_namespace{numericaldifferenti ation.cpp} | 35 | 4 | 0 | 0 | 0 | - | 0 | 3 |

| QuantLib::QuantLib .anonymous_namespace{zigguratrng.cpp} | 0 | 0 | 0 | 0 | 0 | - | 0 | 0 |

| QuantLib::QuantLib .anonymous_namespace{money.cpp} | 5 | 0 | 0 | 0 | 0 | - | 0 | 3 |

| QuantLib::anonymous_namespace{cmsmarketc alibration.cpp} | 87 | 8 | 6 | 0 | 0 | - | 0 | 3 |

| QuantLib::anonymous_namespace{blackformu la.cpp} | 6 | 0 | 0 | 0 | 0 | - | 0 | 1 |

| QuantLib::anonymous_namespace{errors .cpp} | 3 | 0 | 0 | 0 | 0 | - | 0 | 1 |

| QuantLib::boost | 2 | 0 | 0 | 0 | 0 | - | 0 | 1 |

| testsuite::GlobalNamespace | 15593 | 868 | 143 | 0 | 0 | - | 1 | 71 |

| testsuite::anonymous_namespace{americano ption.cpp} | 30 | 7 | 1 | 0 | 0 | - | 1 | 3 |

| testsuite::anonymous_namespace{asianopti ons.cpp} | 6 | 0 | 3 | 0 | 0 | - | 1 | 3 |

| testsuite::anonymous_namespace{assetswap .cpp} | 13 | 0 | 1 | 0 | 0 | - | 1 | 3 |

| testsuite::anonymous_namespace{barrierop tion.cpp} | 11 | 0 | 3 | 0 | 0 | - | 1 | 3 |

| testsuite::anonymous_namespace{basketopt ion.cpp} | 8 | 0 | 4 | 0 | 0 | - | 1 | 2 |

| testsuite::anonymous_namespace{batesmode l.cpp} | 4 | 1 | 1 | 0 | 0 | - | 0 | 0 |

| testsuite::anonymous_namespace{bermudans waption.cpp} | 12 | 0 | 1 | 0 | 0 | - | 1 | 2 |

| testsuite::anonymous_namespace{binaryopt ion.cpp} | 11 | 0 | 1 | 0 | 0 | - | 1 | 3 |

| testsuite::anonymous_namespace{blackdelt acalculator.cpp} | 1 | 0 | 2 | 0 | 0 | - | 1 | 2 |

| testsuite::anonymous_namespace{bonds .cpp} | 4 | 0 | 1 | 0 | 0 | - | 1 | 2 |

| testsuite::anonymous_namespace{brownianb ridge.cpp} | 12 | 2 | 0 | 0 | 0 | - | 0 | 0 |

| testsuite::anonymous_namespace{businessd ayconventions.cpp} | 6 | 0 | 1 | 0 | 0 | - | 1 | 1 |

| testsuite::anonymous_namespace{capfloor .cpp} | 20 | 0 | 1 | 0 | 0 | - | 1 | 3 |

| testsuite::anonymous_namespace{capfloore dcoupon.cpp} | 25 | 0 | 1 | 0 | 0 | - | 1 | 3 |

| testsuite::anonymous_namespace{catbonds .cpp} | 4 | 0 | 1 | 0 | 0 | - | 1 | 3 |

| testsuite::anonymous_namespace{cdo.cpp} | 2 | 0 | 1 | 0 | 0 | - | 1 | 0 |

| testsuite::anonymous_namespace{cliquetop tion.cpp} | 37 | 8 | 0 | 0 | 0 | - | 0 | 3 |

| testsuite::anonymous_namespace{cms.cpp} | 121 | 2 | 1 | 0 | 0 | - | 1 | 3 |

| testsuite::anonymous_namespace{compoundo ption.cpp} | 1 | 0 | 1 | 0 | 0 | - | 1 | 1 |

| testsuite::anonymous_namespace{convertib lebonds.cpp} | 11 | 0 | 1 | 0 | 0 | - | 1 | 2 |

| testsuite::anonymous_namespace{covarianc e.cpp} | 5 | 2 | 0 | 0 | 0 | - | 0 | 1 |

| testsuite::anonymous_namespace{curvestat es.cpp} | 37 | 1 | 1 | 0 | 0 | - | 1 | 3 |

| testsuite::anonymous_namespace{daycounte rs.cpp} | 12 | 0 | 1 | 0 | 0 | - | 1 | 1 |

| testsuite::anonymous_namespace{defaultpr obabilitycurves.cpp} | 63 | 2 | 0 | 0 | 0 | - | 0 | 3 |

| testsuite::anonymous_namespace{digitalco upon.cpp} | 7 | 0 | 1 | 0 | 0 | - | 1 | 2 |

| testsuite::anonymous_namespace{digitalop tion.cpp} | 0 | 0 | 1 | 0 | 0 | - | 1 | 1 |

| testsuite::anonymous_namespace{distribut ions.cpp} | 30 | 4 | 2 | 0 | 0 | - | 1 | 0 |

| testsuite::anonymous_namespace{dividendo ption.cpp} | 44 | 7 | 0 | 0 | 0 | - | 0 | 3 |

| testsuite::anonymous_namespace{doublebar rieroption.cpp} | 0 | 0 | 2 | 0 | 0 | - | 1 | 2 |

| testsuite::anonymous_namespace{doublebin aryoption.cpp} | 0 | 0 | 1 | 0 | 0 | - | 1 | 1 |

| testsuite::anonymous_namespace{europeano ption.cpp} | 31 | 8 | 2 | 0 | 0 | - | 1 | 3 |

| testsuite::anonymous_namespace{extendedt rees.cpp} | 30 | 8 | 1 | 0 | 0 | - | 1 | 3 |

| testsuite::anonymous_namespace{fdheston .cpp} | 0 | 0 | 2 | 0 | 0 | - | 1 | 2 |

| testsuite::anonymous_namespace{fdmlinear op.cpp} | 25 | 2 | 3 | 0 | 0 | - | 0 | 2 |

| testsuite::anonymous_namespace{forwardop tion.cpp} | 36 | 8 | 1 | 0 | 0 | - | 1 | 3 |

| testsuite::anonymous_namespace{garch .cpp} | 5 | 0 | 2 | 0 | 0 | - | 1 | 3 |

| testsuite::anonymous_namespace{gaussianq uadratures.cpp} | 23 | 1 | 0 | 0 | 0 | - | 0 | 2 |

| testsuite::anonymous_namespace{hestonmod el.cpp} | 24 | 2 | 3 | 0 | 0 | - | 1 | 3 |

| testsuite::anonymous_namespace{hestonslv model.cpp} | 146 | 7 | 4 | 0 | 0 | - | 1 | 3 |

| testsuite::anonymous_namespace{hybridhes tonhullwhiteprocess.cpp} | 3 | 0 | 6 | 0 | 0 | - | 1 | 2 |

| testsuite::anonymous_namespace{inflation .cpp} | 0 | 0 | 1 | 0 | 0 | - | 1 | 1 |

| testsuite::anonymous_namespace{inflation capfloor.cpp} | 0 | 0 | 1 | 0 | 0 | - | 0 | 1 |

| testsuite::anonymous_namespace{inflation capflooredcoupon.cpp} | 0 | 0 | 1 | 0 | 0 | - | 0 | 1 |

| testsuite::anonymous_namespace{inflation cpibond.cpp} | 15 | 1 | 2 | 0 | 0 | - | 1 | 3 |

| testsuite::anonymous_namespace{inflation cpicapfloor.cpp} | 0 | 0 | 1 | 0 | 0 | - | 0 | 1 |

| testsuite::anonymous_namespace{inflation cpiswap.cpp} | 0 | 0 | 1 | 0 | 0 | - | 0 | 1 |

| testsuite::anonymous_namespace{inflation volatility.cpp} | 73 | 2 | 0 | 0 | 0 | - | 0 | 3 |

| testsuite::anonymous_namespace{integrals .cpp} | 16 | 0 | 2 | 0 | 0 | - | 0 | 3 |

| testsuite::anonymous_namespace{interestr ates.cpp} | 0 | 0 | 1 | 0 | 0 | - | 1 | 2 |

| testsuite::anonymous_namespace{interpola tions.cpp} | 47 | 5 | 2 | 0 | 0 | - | 1 | 2 |

| testsuite::anonymous_namespace{jumpdiffu sion.cpp} | 0 | 0 | 1 | 0 | 0 | - | 1 | 1 |

| testsuite::anonymous_namespace{libormark etmodelprocess.cpp} | 0 | 0 | 0 | 0 | 0 | - | 0 | 0 |

| testsuite::anonymous_namespace{linearlea stsquaresregression.cpp} | 1 | 0 | 0 | 0 | 0 | - | 0 | 1 |

| testsuite::anonymous_namespace{lookbacko ptions.cpp} | 0 | 0 | 1 | 0 | 0 | - | 1 | 1 |

| testsuite::anonymous_namespace{lowdiscre pancysequences.cpp} | 79 | 5 | 3 | 0 | 0 | - | 1 | 3 |

| testsuite::anonymous_namespace{margrabeo ption.cpp} | 1 | 0 | 2 | 0 | 0 | - | 1 | 0 |

| testsuite::anonymous_namespace{marketmod el.cpp} | 192 | 5 | 3 | 0 | 0 | - | 1 | 4 |

| testsuite::anonymous_namespace{marketmod el_cms.cpp} | 116 | 2 | 3 | 0 | 0 | - | 1 | 3 |

| testsuite::anonymous_namespace{marketmod el_smm.cpp} | 115 | 2 | 3 | 0 | 0 | - | 1 | 3 |

| testsuite::anonymous_namespace{marketmod el_smmcapletalphacalibration.cpp} | 40 | 1 | 3 | 0 | 0 | - | 0 | 3 |

| testsuite::anonymous_namespace{marketmod el_smmcapletcalibration.cpp} | 40 | 1 | 3 | 0 | 0 | - | 0 | 3 |

| testsuite::anonymous_namespace{marketmod el_smmcaplethomocalibration.cpp} | 40 | 1 | 3 | 0 | 0 | - | 0 | 3 |

| testsuite::anonymous_namespace{markovfun ctional.cpp} | 119 | 7 | 0 | 0 | 0 | - | 0 | 3 |

| testsuite::anonymous_namespace{matrices .cpp} | 99 | 2 | 0 | 0 | 0 | - | 0 | 1 |

| testsuite::anonymous_namespace{mclongsta ffschwartzengine.cpp} | 5 | 1 | 2 | 0 | 0 | - | 0 | 1 |

| testsuite::anonymous_namespace{noarbsabr .cpp} | 4 | 0 | 0 | 0 | 0 | - | 0 | 1 |

| testsuite::anonymous_namespace{nthtodefa ult.cpp} | 0 | 0 | 2 | 0 | 0 | - | 1 | 0 |

| testsuite::anonymous_namespace{numerical differentiation.cpp} | 19 | 2 | 0 | 0 | 0 | - | 0 | 3 |

| testsuite::anonymous_namespace{observabl e.cpp} | 3 | 0 | 1 | 0 | 0 | - | 1 | 1 |

| testsuite::anonymous_namespace{ode.cpp} | 11 | 0 | 4 | 0 | 0 | - | 0 | 3 |

| testsuite::anonymous_namespace{operators .cpp} | 0 | 0 | 0 | 0 | 0 | - | 0 | 0 |

| testsuite::anonymous_namespace{optimizer s.cpp} | 108 | 6 | 9 | 0 | 0 | - | 1 | 3 |

| testsuite::anonymous_namespace{optionlet stripper.cpp} | 345 | 4 | 1 | 0 | 0 | - | 1 | 3 |

| testsuite::anonymous_namespace{overnight indexedswap.cpp} | 0 | 0 | 4 | 0 | 0 | - | 1 | 2 |

| testsuite::anonymous_namespace{partialti mebarrieroption.cpp} | 0 | 0 | 1 | 0 | 0 | - | 1 | 0 |

| testsuite::anonymous_namespace{pathgener ator.cpp} | 35 | 2 | 0 | 0 | 0 | - | 0 | 1 |

| testsuite::anonymous_namespace{piecewise yieldcurve.cpp} | 122 | 4 | 3 | 0 | 0 | - | 1 | 4 |

| testsuite::anonymous_namespace{piecewise zerospreadedtermstructure.cpp} | 14 | 1 | 2 | 0 | 0 | - | 1 | 3 |

| testsuite::anonymous_namespace{quantoopt ion.cpp} | 0 | 0 | 4 | 0 | 0 | - | 1 | 2 |

| testsuite::anonymous_namespace{quotes .cpp} | 6 | 0 | 0 | 0 | 0 | - | 0 | 0 |

| testsuite::anonymous_namespace{rangeaccr ual.cpp} | 3249 | 2 | 1 | 0 | 0 | - | 1 | 3 |

| testsuite::anonymous_namespace{riskneutr aldensitycalculator.cpp} | 24 | 1 | 2 | 0 | 0 | - | 1 | 3 |

| testsuite::anonymous_namespace{rounding .cpp} | 0 | 0 | 1 | 0 | 0 | - | 1 | 0 |

| testsuite::anonymous_namespace{schedule .cpp} | 3 | 1 | 0 | 0 | 0 | - | 0 | 2 |

| testsuite::anonymous_namespace{shortrate models.cpp} | 0 | 0 | 1 | 0 | 0 | - | 1 | 0 |

| testsuite::anonymous_namespace{solvers .cpp} | 48 | 3 | 4 | 0 | 0 | - | 0 | 1 |

| testsuite::anonymous_namespace{stats .cpp} | 75 | 2 | 0 | 0 | 0 | - | 0 | 1 |

| testsuite::anonymous_namespace{swap.cpp} | 0 | 0 | 1 | 0 | 0 | - | 1 | 2 |

| testsuite::anonymous_namespace{swapforwa rdmappings.cpp} | 29 | 2 | 1 | 0 | 0 | - | 1 | 3 |

| testsuite::anonymous_namespace{swaption .cpp} | 0 | 0 | 1 | 0 | 0 | - | 1 | 2 |

| testsuite::anonymous_namespace{swaptionv olatilitycube.cpp} | 19 | 5 | 1 | 0 | 0 | - | 1 | 3 |

| testsuite::anonymous_namespace{swaptionv olatilitymatrix.cpp} | 30 | 2 | 1 | 0 | 0 | - | 1 | 3 |

| testsuite::anonymous_namespace{swingopti on.cpp} | 8 | 0 | 1 | 0 | 0 | - | 0 | 3 |

| testsuite::anonymous_namespace{termstruc tures.cpp} | 10 | 1 | 2 | 0 | 0 | - | 1 | 2 |

| testsuite::boost | 0 | 0 | 1 | 0 | 0 | - | 0 | 1 |

| testsuite::anonymous_namespace{tqreigend ecomposition.cpp} | 0 | 0 | 0 | 0 | 0 | - | 0 | 0 |

| testsuite::anonymous_namespace{tracing .cpp} | 13 | 0 | 1 | 0 | 0 | - | 0 | 1 |

| testsuite::anonymous_namespace{twoassetb arrieroption.cpp} | 0 | 0 | 1 | 0 | 0 | - | 1 | 2 |

| testsuite::QuantLib | 22 | 1 | 3 | 0 | 0 | - | 4 | 3 |

| testsuite::QuantLib.detail | 2 | 0 | 1 | 0 | 0 | - | 0 | 2 |

| testsuite::anonymous_namespace{varianceg amma.cpp} | 0 | 0 | 2 | 0 | 0 | - | 1 | 1 |

| testsuite::anonymous_namespace{variances waps.cpp} | 0 | 0 | 3 | 0 | 0 | - | 1 | 2 |

| testsuite::anonymous_namespace{vpp.cpp} | 14 | 0 | 3 | 0 | 0 | - | 0 | 2 |

| testsuite::anonymous_namespace{quantlibt estsuite.cpp} | 12 | 0 | 0 | 0 | 0 | - | 0 | 3 |

| Swap::GlobalNamespace | 209 | 0 | 0 | 0 | 0 | - | 0 | 3 |

| EquityOption::GlobalNamespace | 76 | 1 | 0 | 0 | 0 | - | 0 | 3 |

| ConvertibleBonds::GlobalNamespace | 87 | 3 | 0 | 0 | 0 | - | 0 | 3 |

| FRA::GlobalNamespace | 96 | 1 | 0 | 0 | 0 | - | 0 | 3 |

| Repo::GlobalNamespace | 55 | 0 | 0 | 0 | 0 | - | 0 | 3 |

| Replication::GlobalNamespace | 106 | 1 | 0 | 0 | 0 | - | 0 | 3 |

| BermudanSwaption::GlobalNamespace | 71 | 2 | 0 | 0 | 0 | - | 0 | 3 |

| DiscreteHedging::GlobalNamespace | 115 | 1 | 2 | 0 | 0 | - | 0 | 3 |

| FittedBondCurve::GlobalNamespace | 141 | 3 | 0 | 0 | 0 | - | 0 | 3 |

| CallableBonds::GlobalNamespace | 94 | 1 | 0 | 0 | 0 | - | 0 | 3 |

| CDS::GlobalNamespace | 60 | 1 | 0 | 0 | 0 | - | 0 | 3 |

| Bonds::GlobalNamespace | 88 | 1 | 0 | 0 | 0 | - | 0 | 3 |

| MarketModels::GlobalNamespace | 259 | 6 | 0 | 0 | 0 | - | 0 | 3 |

| Gaussian1dModels::GlobalNamespace | 177 | 3 | 1 | 0 | 0 | - | 0 | 3 |

| MultidimIntegral::GlobalNamespace | 22 | 1 | 1 | 0 | 0 | - | 0 | 2 |

| LatentModel::GlobalNamespace | 76 | 2 | 0 | 0 | 0 | - | 0 | 3 |

| BasketLosses::GlobalNamespace | 81 | 1 | 0 | 0 | 0 | - | 0 | 3 |

| CVAIRS::GlobalNamespace | 69 | 1 | 0 | 0 | 0 | - | 0 | 3 |

| Project Rules | 803 |

| Quality Gates | 803 |

|

| Quality Gate Pass: Percentage Code Coverage |

Scalar Result: N/A %

| Quality Gate Pass: Percentage Coverage on New Code |

Scalar Result: N/A %

| Quality Gate Pass: Percentage Coverage on Refactored Code |

Scalar Result: N/A %

| Quality Gate Pass: Blocker Issues |

No issue matched

| Quality Gate Fail: Critical Issues |

12 issues matched

| 12 issues | Severity | Debt | Annual Interest | Full Name |

|---|---|---|---|---|

| Critical issue on: anonymous_namespace{rangeaccrual.cpp} .CommonVars | Critical | 1d 2h | 2h 0min | Rule violated: Avoid types too big |

| Critical issue on: MarketModelTest.testPathwiseVegas() | Critical | 6h 0min | 2h 0min | Rule violated: Avoid methods with too many local variables |

| Critical issue on: MarketModelTest .testPathwiseMarketVegas() | Critical | 6h 0min | 2h 0min | Rule violated: Avoid methods with too many local variables |

| Critical issue on: AssetSwapTest .testSpecializedBondVsGenericBondUsingAs w() | Critical | 6h 0min | 2h 0min | Rule violated: Avoid methods with too many local variables |

| Critical issue on: AssetSwapTest.testMASWWithGenericBond() | Critical | 6h 0min | 2h 0min | Rule violated: Avoid methods with too many local variables |

| Critical issue on: QuantLib .AnalyticGJRGARCHEngine.calculate() | Critical | 6h 0min | 2h 0min | Rule violated: Avoid methods with too many local variables |

| Critical issue on: AssetSwapTest .testSpecializedBondVsGenericBond() | Critical | 6h 0min | 2h 0min | Rule violated: Avoid methods with too many local variables |

| Critical issue on: __Globals.main(int,char**) | Critical | 6h 0min | 2h 0min | Rule violated: Avoid methods with too many local variables |

| Critical issue on: VPPTest.testVPPPricing() | Critical | 6h 0min | 2h 0min | Rule violated: Avoid methods with too many local variables |

| Critical issue on: __Globals.InverseFloater(Real) | Critical | 6h 0min | 2h 0min | Rule violated: Avoid methods with too many local variables |

| Critical issue on: AssetSwapTest.testGenericBondImplied() | Critical | 6h 0min | 2h 0min | Rule violated: Avoid methods with too many local variables |

| Critical issue on: __Globals.Bermudan() | Critical | 6h 0min | 2h 0min | Rule violated: Avoid methods with too many local variables |

Statistics

| Stat | Severity | Debt | Annual Interest |

|---|---|---|---|

| Sum: | - | 9d 4h | 3d 0h |

| Average: | - | 6h 20min | 2h 0min |

| Minimum: | - | 6h 0min | 2h 0min |

| Maximum: | - | 1d 2h | 2h 0min |

| Standard deviation: | - | 1h 6min | 0min 0s |

| Variance: | - | 550d | 0min 0s |

| Quality Gate Pass: New Blocker / Critical / High Issues |

No issue matched

| Quality Gate Fail: Critical Rules Violated |

3 rules matched

| 3 rules | issues | Full Name |

|---|---|---|

| Avoid types too big | 20 issues | Rule |

| Avoid methods too big, too complex | 311 issues | Rule |

| Avoid methods with too many parameters | 181 issues | Rule |

Statistics

| Stat | issues |

|---|---|

| Sum: | 512 |

| Average: | 170.67 |

| Minimum: | 20 |

| Maximum: | 311 |

| Standard deviation: | 119.02 |

| Variance: | 14 167 |

| Quality Gate Pass: Percentage Debt |

Scalar Result: 10.12 %

| Quality Gate Pass: New Debt since Baseline |

Scalar Result: 0 man-days

| Quality Gate Fail: Debt Rating per Namespace |

41 namespaces matched

| 41 namespaces | debtRating | debtRatio | devTimeInManDay | debtInManDay | issues | Full Name |

|---|---|---|---|---|---|---|

| D | 24.51 | 6d 1h | 1d 4h | 25 issues | ||

| QuantLib.MINPACK | D | 27.42 | 6d 3h | 1d 6h | 10 issues | QuantLib.MINPACK |

| QuantLib .anonymous_namespace{bivariatestudenttdi stribution.cpp} | D | 24.27 | 1d 4h | 3h 2min | 2 issues | QuantLib .anonymous_namespace{bivariatestudenttdi stribution.cpp} |

| QuantLib .anonymous_namespace{capletcoterminalmax homogeneity.cpp} | D | 43.23 | 2d 0h | 7h 13min | 4 issues | QuantLib .anonymous_namespace{capletcoterminalmax homogeneity.cpp} |

| QuantLib .anonymous_namespace{hestonblackvolsurfa ce.cpp} | E | 231.48 | 25min | 1h 0min | 1 issue | QuantLib .anonymous_namespace{hestonblackvolsurfa ce.cpp} |

| QuantLib.anonymous_namespace{stulzengine .cpp} | E | 74.56 | 4h 10min | 3h 6min | 4 issues | QuantLib.anonymous_namespace{stulzengine .cpp} |

| QuantLib .anonymous_namespace{bjerksundstenslande ngine.cpp} | D | 33.07 | 3h 1min | 1h 0min | 1 issue | QuantLib .anonymous_namespace{bjerksundstenslande ngine.cpp} |

| QuantLib .anonymous_namespace{integralhestonvaria nceoptionengine.cpp} | D | 42.64 | 2d 1h | 7h 25min | 7 issues | QuantLib .anonymous_namespace{integralhestonvaria nceoptionengine.cpp} |

| D | 28.64 | 298d | 85d | 800 issues | ||

| anonymous_namespace{americanoption.cpp} | D | 35.61 | 6h 2min | 2h 9min | 1 issue | anonymous_namespace{americanoption.cpp} |

| anonymous_namespace{capflooredcoupon .cpp} | D | 29.03 | 7h 3min | 2h 2min | 2 issues | anonymous_namespace{capflooredcoupon .cpp} |

| anonymous_namespace{cdo.cpp} | E | 57.87 | 1h 43min | 1h 0min | 1 issue | anonymous_namespace{cdo.cpp} |

| anonymous_namespace{cliquetoption.cpp} | E | 55.28 | 5h 36min | 3h 6min | 3 issues | anonymous_namespace{cliquetoption.cpp} |

| anonymous_namespace{compoundoption.cpp} | D | 36.41 | 2h 52min | 1h 2min | 1 issue | anonymous_namespace{compoundoption.cpp} |

| anonymous_namespace{convertiblebonds .cpp} | D | 23.41 | 4h 53min | 1h 8min | 1 issue | anonymous_namespace{convertiblebonds .cpp} |

| anonymous_namespace{defaultprobabilitycu rves.cpp} | D | 35.84 | 1d 1h | 3h 24min | 4 issues | anonymous_namespace{defaultprobabilitycu rves.cpp} |

| anonymous_namespace{dividendoption.cpp} | D | 29.55 | 6h 46min | 2h 0min | 1 issue | anonymous_namespace{dividendoption.cpp} |

| anonymous_namespace{doublebarrieroption .cpp} | D | 22.76 | 4h 36min | 1h 2min | 1 issue | anonymous_namespace{doublebarrieroption .cpp} |

| anonymous_namespace{europeanoption.cpp} | D | 25.37 | 1d 0h | 2h 7min | 2 issues | anonymous_namespace{europeanoption.cpp} |

| anonymous_namespace{extendedtrees.cpp} | D | 35.88 | 5h 54min | 2h 7min | 2 issues | anonymous_namespace{extendedtrees.cpp} |

| anonymous_namespace{forwardoption.cpp} | D | 42.89 | 7h 3min | 3h 1min | 3 issues | anonymous_namespace{forwardoption.cpp} |

| anonymous_namespace{hestonslvmodel.cpp} | D | 32.88 | 3d 4h | 1d 1h | 6 issues | anonymous_namespace{hestonslvmodel.cpp} |

| anonymous_namespace{inflationvolatility .cpp} | D | 29.46 | 1d 4h | 3h 41min | 2 issues | anonymous_namespace{inflationvolatility .cpp} |

| anonymous_namespace{margrabeoption.cpp} | D | 22.42 | 5h 19min | 1h 11min | 1 issue | anonymous_namespace{margrabeoption.cpp} |

| anonymous_namespace{piecewiseyieldcurve .cpp} | D | 29.71 | 3d 1h | 7h 26min | 6 issues | anonymous_namespace{piecewiseyieldcurve .cpp} |

| anonymous_namespace{swaptionvolatilityma trix.cpp} | D | 21.17 | 6h 20min | 1h 20min | 2 issues | anonymous_namespace{swaptionvolatilityma trix.cpp} |

| D | 24.37 | 3d 6h | 7h 24min | 2 issues | ||

| D | 27.07 | 1d 3h | 3h 2min | 2 issues | ||

| D | 37.85 | 1d 4h | 4h 51min | 3 issues | ||

| D | 34.54 | 1d 6h | 4h 52min | 2 issues | ||

| D | 35.09 | 1d 0h | 2h 52min | 2 issues | ||

| D | 29.14 | 1d 7h | 4h 31min | 2 issues | ||

| D | 28.78 | 1d 3h | 3h 13min | 3 issues | ||

| D | 37.15 | 2d 4h | 7h 45min | 2 issues | ||

| D | 32.71 | 1d 5h | 4h 34min | 3 issues | ||

| D | 30.14 | 1d 0h | 2h 41min | 2 issues | ||

| D | 43.24 | 1d 4h | 5h 36min | 2 issues | ||

| D | 39.54 | 4d 6h | 1d 7h | 5 issues | ||

| D | 47.88 | 1d 3h | 5h 22min | 2 issues | ||

| D | 36.88 | 1d 3h | 4h 24min | 2 issues | ||

| D | 35.18 | 1d 2h | 3h 35min | 2 issues |

Statistics

| Stat | debtRating | debtRatio | devTimeInManDay | debtInManDay | issues |

|---|---|---|---|---|---|

| Sum: | - | 1 615 | 365d | 107d | 929 |

| Average: | - | 39.39 | 8d 7h | 2d 4h | 22.66 |

| Minimum: | - | 21.17 | 25min | 1h 0min | 1 |

| Maximum: | - | 231.48 | 298d | 85d | 800 |

| Standard deviation: | - | 32.1 | 45d | 13d 0h | 122.97 |

| Variance: | - | 1 030 | overflow | 4 940 458d | 15 122 |

| Quality Gate Pass: New Annual Interest since Baseline |

Scalar Result: 0 man-days

| Project Rules | 247253 |

| Code Smells | 063 |

|

| Critical Rule Violated: Avoid types too big |

• How to Fix Issues: Types with many lines of code should be split in a group of smaller types. To refactor a God Class you'll need patience, and you might even need to recreate everything from scratch. Here are a few refactoring advices: • The logic in the God Class must be splitted in smaller classes. These smaller classes can eventually become private classes nested in the original God Class, whose instances objects become composed of instances of smaller nested classes. • Smaller classes partitioning should be driven by the multiple responsibilities handled by the God Class. To identify these responsibilities it often helps to look for subsets of methods strongly coupled with subsets of fields. • If the God Class contains way more logic than states, a good option can be to define one or several static classes that contains no static field but only pure static methods. A pure static method is a function that computes a result only from inputs parameters, it doesn't read nor assign any static or instance field. The main advantage of pure static methods is that they are easily testable. • Try to maintain the interface of the God Class at first and delegate calls to the new extracted classes. In the end the God Class should be a pure facade without its own logic. Then you can keep it for convenience or throw it away and start to use the new classes only. • Unit Tests can help: write tests for each method before extracting it to ensure you don't break functionality. The estimated Debt, which means the effort to fix such issue, varies linearly from 1 hour for a 200 lines of code type, up to 10 hours for a type with 2.000 or more lines of code. In Debt and Interest computation, this rule takes account of the fact that static types with no mutable fields are just a collection of static methods that can be easily splitted and moved from one type to another.

20 types matched

-

Formatting: bold means added, underlined means code was changed,

strike-boldmeans removed (since baseline)

| 20 types | locJustMyCode | Methods | Fields | Debt | Annual Interest | Full Name |

|---|---|---|---|---|---|---|

| CommonVars | 3 249 | 3 methods | 42 fields | 1d 2h | 2h 0min | anonymous_namespace{rangeaccrual.cpp} .CommonVars |

| MarketModelTest | 1 252 | 21 methods | no field | 6h 15min | 1h 10min | MarketModelTest |

| CalendarTest | 1 190 | 23 methods | no field | 5h 57min | 1h 6min | CalendarTest |

| InterpolationTest | 842 | 21 methods | no field | 4h 12min | 44min | InterpolationTest |

| AssetSwapTest | 777 | 10 methods | no field | 3h 53min | 39min | AssetSwapTest |

| HestonSLVModelTest | 543 | 18 methods | no field | 2h 42min | 24min | HestonSLVModelTest |

| FdmLinearOpTest | 423 | 17 methods | no field | 2h 6min | 16min | FdmLinearOpTest |

| HestonModelTest | 420 | 18 methods | no field | 2h 6min | 16min | HestonModelTest |

| HybridHestonHullWhiteProcessTest | 378 | 14 methods | no field | 1h 53min | 13min | HybridHestonHullWhiteProcessTest |

| BondTest | 359 | 13 methods | no field | 1h 47min | 12min | BondTest |

| CommonVars | 345 | 7 methods | 15 fields | 1h 43min | 11min | anonymous_namespace{optionletstripper .cpp}.CommonVars |

| EuropeanOptionTest | 315 | 21 methods | no field | 1h 34min | 9min | EuropeanOptionTest |

| VPPTest | 278 | 7 methods | no field | 1h 23min | 7min | VPPTest |

| DigitalCouponTest | 275 | 9 methods | no field | 1h 22min | 6min | DigitalCouponTest |

| MarkovFunctional | 270 | 33 methods | 23 fields | 1h 21min | 6min | QuantLib.MarkovFunctional |

| SVD | 258 | 9 methods | 6 fields | 1h 17min | 5min | QuantLib.SVD |

| MarkovFunctionalTest | 258 | 7 methods | no field | 1h 17min | 5min | MarkovFunctionalTest |

| AsianOptionTest | 255 | 13 methods | no field | 1h 16min | 5min | AsianOptionTest |

| DividendOptionTest | 228 | 11 methods | no field | 1h 8min | 3min 50s | DividendOptionTest |

| BlackDeltaCalculatorTest | 203 | 5 methods | no field | 1h 0min | 2min 11s | BlackDeltaCalculatorTest |

| Rule Violated: Avoid types with too many methods |

• How to Fix Issues: To refactor properly a God Class please read HowToFix advices from the default rule Types to Big. // The estimated Debt, which means the effort to fix such issue, varies linearly from 1 hour for a type with 20 methods, up to 10 hours for a type with 200 or more methods. In Debt and Interest computation, this rule takes account of the fact that static types with no mutable fields are just a collection of static methods that can be easily splitted and moved from one type to another.

31 types matched

-

Formatting: bold means added, underlined means code was changed,

strike-boldmeans removed (since baseline)

| 31 types | nbMethods | instanceMethods | staticMethods | # lines of code (LOC) | Debt | Annual Interest | Full Name |

|---|---|---|---|---|---|---|---|

| Basket | 51 | 51 methods | no method | 85 | 2h 33min | 22min | QuantLib.Basket |

| BondFunctions | 39 | no method | 39 methods | 113 | 1h 57min | 14min | QuantLib.BondFunctions |

| Matrix | 36 | 36 methods | no method | 64 | 1h 48min | 12min | QuantLib.Matrix |

| MarkovFunctional | 33 | 33 methods | no method | 270 | 1h 39min | 10min | QuantLib.MarkovFunctional |

| Date | 33 | 18 methods | 15 methods | 128 | 1h 39min | 10min | QuantLib.Date |

| AnalyticPartialTimeBarrierOptionEngine | 33 | 33 methods | no method | 97 | 1h 39min | 10min | QuantLib .AnalyticPartialTimeBarrierOptionEngine |

| Bond | 31 | 31 methods | no method | 85 | 1h 33min | 9min | QuantLib.Bond |

| SwaptionVolatilityStructure | 30 | 30 methods | no method | 66 | 1h 30min | 8min | QuantLib.SwaptionVolatilityStructure |

| MakeVanillaSwap | 29 | 29 methods | no method | 57 | 1h 27min | 7min | QuantLib.MakeVanillaSwap |

| AnalyticCompoundOptionEngine | 29 | 29 methods | no method | 69 | 1h 27min | 7min | QuantLib.AnalyticCompoundOptionEngine |

| FdmSquareRootFwdOp | 28 | 28 methods | no method | 95 | 1h 24min | 7min | QuantLib.FdmSquareRootFwdOp |

| AnalyticTwoAssetBarrierEngine | 28 | 28 methods | no method | 40 | 1h 24min | 7min | QuantLib.AnalyticTwoAssetBarrierEngine |

| SampledCurve | 26 | 26 methods | no method | 73 | 1h 18min | 5min | QuantLib.SampledCurve |

| AbcdAtmVolCurve | 26 | 26 methods | no method | 62 | 1h 18min | 5min | QuantLib.AbcdAtmVolCurve |

| CPISwap | 25 | 25 methods | no method | 44 | 1h 15min | 5min | QuantLib.CPISwap |

| MakeCms | 25 | 25 methods | no method | 45 | 1h 15min | 5min | QuantLib.MakeCms |

| CPICapFloorTermPriceSurface | 24 | 24 methods | no method | 66 | 1h 12min | 4min 37s | QuantLib.CPICapFloorTermPriceSurface |

| DigitalCmsLeg | 24 | 24 methods | no method | 46 | 1h 12min | 4min 37s | QuantLib.DigitalCmsLeg |

| DigitalIborLeg | 24 | 24 methods | no method | 46 | 1h 12min | 4min 37s | QuantLib.DigitalIborLeg |

| DigitalCmsSpreadLeg | 24 | 24 methods | no method | 46 | 1h 12min | 4min 37s | QuantLib.DigitalCmsSpreadLeg |

| Distribution | 24 | 24 methods | no method | 168 | 1h 12min | 4min 37s | QuantLib.Distribution |

| ZabrModel | 23 | 23 methods | no method | 136 | 1h 9min | 3min 58s | QuantLib.ZabrModel |

| CalendarTest | 23 | no method | 23 methods | 1 190 | 1h 9min | 3min 58s | CalendarTest |

| Schedule | 22 | 22 methods | no method | 89 | 1h 6min | 3min 18s | QuantLib.Schedule |

| YoYCapFloorTermPriceSurface | 22 | 22 methods | no method | 12 | 1h 6min | 3min 18s | QuantLib.YoYCapFloorTermPriceSurface |

| CreditDefaultSwap | 21 | 21 methods | no method | 59 | 1h 3min | 2min 39s | QuantLib.CreditDefaultSwap |

| YearOnYearInflationSwap | 21 | 21 methods | no method | 46 | 1h 3min | 2min 39s | QuantLib.YearOnYearInflationSwap |

| SmileSection | 21 | 21 methods | no method | 73 | 1h 3min | 2min 39s | QuantLib.SmileSection |

| EuropeanOptionTest | 21 | no method | 21 methods | 315 | 1h 3min | 2min 39s | EuropeanOptionTest |

| InterpolationTest | 21 | no method | 21 methods | 842 | 1h 3min | 2min 39s | InterpolationTest |

| MarketModelTest | 21 | no method | 21 methods | 1 252 | 1h 3min | 2min 39s | MarketModelTest |

| Rule Violated: Avoid types with too many fields |

• How to Fix Issues: To refactor such type and increase code quality and maintainability, certainly you'll have to group subsets of fields into smaller types and dispatch the logic implemented into the methods into these smaller types. More refactoring advices can be found in the default rule Types to Big, HowToFix section. The estimated Debt, which means the effort to fix such issue, varies linearly from 1 hour for a type with 15 fields, to up to 10 hours for a type with 200 or more fields.

54 types matched

-

Formatting: bold means added, underlined means code was changed,

strike-boldmeans removed (since baseline)

| 54 types | instanceFields | staticFields | methodsAssigningFields | Debt | Annual Interest | Full Name |

|---|---|---|---|---|---|---|

| CommonVars | 42 fields | no field | 17 methods | 2h 18min | 19min | anonymous_namespace{rangeaccrual.cpp} .CommonVars |

| LognormalCmsSpreadPricer | 37 fields | no field | 17 methods | 2h 4min | 16min | QuantLib.LognormalCmsSpreadPricer |

| PathwiseVegasOuterAccountingEngine | 33 fields | no field | 1 method | 1h 52min | 13min | QuantLib .PathwiseVegasOuterAccountingEngine |

| PathwiseVegasAccountingEngine | 30 fields | no field | 1 method | 1h 43min | 11min | QuantLib.PathwiseVegasAccountingEngine |

| MakeCms | 29 fields | no field | 11 methods | 1h 40min | 10min | QuantLib.MakeCms |

| MakeVanillaSwap | 27 fields | no field | 15 methods | 1h 35min | 9min | QuantLib.MakeVanillaSwap |

| AmericanPayoffAtHit | 25 fields | no field | 6 methods | 1h 29min | 8min | QuantLib.AmericanPayoffAtHit |

| CommonVars | 24 fields | no field | 15 methods | 1h 26min | 7min | anonymous_namespace{piecewiseyieldcurve .cpp}.CommonVars |

| PathwiseAccountingEngine | 23 fields | no field | 1 method | 1h 23min | 7min | QuantLib.PathwiseAccountingEngine |

| LogNormalFwdRateEulerConstrained | 23 fields | no field | 1 method | 1h 23min | 7min | QuantLib .LogNormalFwdRateEulerConstrained |

| SVDDFwdRatePc | 23 fields | no field | 1 method | 1h 23min | 7min | QuantLib.SVDDFwdRatePc |

| MarkovFunctional | 23 fields | no field | 2 methods | 1h 23min | 7min | QuantLib.MarkovFunctional |

| CDO | 23 fields | no field | 19 methods | 1h 23min | 7min | QuantLib.CDO |

| AnalyticGJRGARCHEngine | 22 fields | no field | 22 methods | 1h 20min | 6min | QuantLib.AnalyticGJRGARCHEngine |

| LinearTsrPricer | 21 fields | no field | 5 methods | 1h 17min | 5min | QuantLib.LinearTsrPricer |

| HestonSLVFokkerPlanckFdmParams | 19 fields | no field | no method | 1h 11min | 4min 33s | QuantLib.HestonSLVFokkerPlanckFdmParams |

| LogNormalCmSwapRatePc | 19 fields | no field | 2 methods | 1h 11min | 4min 33s | QuantLib.LogNormalCmSwapRatePc |

| LogNormalFwdRateBalland | 19 fields | no field | 2 methods | 1h 11min | 4min 33s | QuantLib.LogNormalFwdRateBalland |

| LogNormalFwdRateIpc | 19 fields | no field | 2 methods | 1h 11min | 4min 33s | QuantLib.LogNormalFwdRateIpc |

| MarkovFunctional+ModelOutputs | 19 fields | no field | 5 methods | 1h 11min | 4min 33s | QuantLib.MarkovFunctional+ModelOutputs |

| CmsMarket | 19 fields | no field | no method | 1h 11min | 4min 33s | QuantLib.CmsMarket |

| SviInterpolatedSmileSection | 19 fields | no field | no method | 1h 11min | 4min 33s | QuantLib.SviInterpolatedSmileSection |

| MakeArithmeticAverageOIS | 19 fields | no field | 17 methods | 1h 11min | 4min 33s | QuantLib.MakeArithmeticAverageOIS |

| MargrabeOptionTwoData | 19 fields | no field | 6 methods | 1h 11min | 4min 33s | anonymous_namespace{margrabeoption.cpp} .MargrabeOptionTwoData |

| CPISwap | 18 fields | no field | 4 methods | 1h 8min | 3min 54s | QuantLib.CPISwap |

| CPILeg | 18 fields | no field | 5 methods | 1h 8min | 3min 54s | QuantLib.CPILeg |

| LogNormalCotSwapRatePc | 18 fields | no field | 2 methods | 1h 8min | 3min 54s | QuantLib.LogNormalCotSwapRatePc |

| LogNormalFwdRatePc | 18 fields | no field | 2 methods | 1h 8min | 3min 54s | QuantLib.LogNormalFwdRatePc |

| LongstaffSchwartzExerciseStrategy | 18 fields | no field | 13 methods | 1h 8min | 3min 54s | QuantLib .LongstaffSchwartzExerciseStrategy |

| G2+SwaptionPricingFunction | 18 fields | no field | 19 methods | 1h 8min | 3min 54s | QuantLib.G2+SwaptionPricingFunction |

| SabrInterpolatedSmileSection | 18 fields | no field | no method | 1h 8min | 3min 54s | QuantLib.SabrInterpolatedSmileSection |

| BlackCalculator | 18 fields | no field | 17 methods | 1h 8min | 3min 54s | QuantLib.BlackCalculator |

| CreditRiskPlus | 18 fields | no field | 13 methods | 1h 8min | 3min 54s | QuantLib.CreditRiskPlus |

| CommonVars | 18 fields | no field | 7 methods | 1h 8min | 3min 54s | anonymous_namespace{convertiblebonds .cpp}.CommonVars |

| GemanRoncoroniProcess | 17 fields | no field | 17 methods | 1h 5min | 3min 16s | QuantLib.GemanRoncoroniProcess |

| DigitalCoupon | 17 fields | no field | 4 methods | 1h 5min | 3min 16s | QuantLib.DigitalCoupon |

| LogNormalFwdRateEuler | 17 fields | no field | 1 method | 1h 5min | 3min 16s | QuantLib.LogNormalFwdRateEuler |

| LogNormalFwdRateiBalland | 17 fields | no field | 2 methods | 1h 5min | 3min 16s | QuantLib.LogNormalFwdRateiBalland |

| CTSMMCapletCalibration | 17 fields | no field | 7 methods | 1h 5min | 3min 16s | QuantLib.CTSMMCapletCalibration |

| NoArbSabrInterpolatedSmileSection | 17 fields | no field | no method | 1h 5min | 3min 16s | QuantLib .NoArbSabrInterpolatedSmileSection |

| FokkerPlanckFwdTestCase | 17 fields | no field | no method | 1h 5min | 3min 16s | anonymous_namespace{hestonslvmodel.cpp} .FokkerPlanckFwdTestCase |

| CommonVars | 17 fields | no field | no method | 1h 5min | 3min 16s | anonymous_namespace{overnightindexedswap .cpp}.CommonVars |

| DigitalCmsLeg | 16 fields | no field | 6 methods | 1h 2min | 2min 38s | QuantLib.DigitalCmsLeg |

| DigitalIborLeg | 16 fields | no field | 6 methods | 1h 2min | 2min 38s | QuantLib.DigitalIborLeg |

| UpperBoundEngine | 16 fields | no field | no method | 1h 2min | 2min 38s | QuantLib.UpperBoundEngine |

| AnalyticHestonEngine+Fj_Helper | 16 fields | no field | 33 methods | 1h 2min | 2min 38s | QuantLib.AnalyticHestonEngine+Fj_Helper |

| DigitalCmsSpreadLeg | 16 fields | no field | 6 methods | 1h 2min | 2min 38s | QuantLib.DigitalCmsSpreadLeg |

| Basket | 16 fields | no field | 4 methods | 1h 2min | 2min 38s | QuantLib.Basket |

| RiskyAssetSwap | 16 fields | no field | 15 methods | 1h 2min | 2min 38s | QuantLib.RiskyAssetSwap |

| NonstandardSwap+arguments | 16 fields | no field | 2 methods | 1h 2min | 2min 38s | QuantLib.NonstandardSwap+arguments |

| CommonVars | 16 fields | no field | 7 methods | 1h 2min | 2min 38s | anonymous_namespace{capflooredcoupon .cpp}.CommonVars |

| CompoundOptionData | 16 fields | no field | 1 method | 1h 2min | 2min 38s | anonymous_namespace{compoundoption.cpp} .CompoundOptionData |

| DoubleBarrierFxOptionData | 16 fields | no field | 1 method | 1h 2min | 2min 38s | anonymous_namespace{doublebarrieroption .cpp}.DoubleBarrierFxOptionData |

| QuantoDoubleBarrierOptionData | 16 fields | no field | no method | 1h 2min | 2min 38s | anonymous_namespace{quantooption.cpp} .QuantoDoubleBarrierOptionData |

| Critical Rule Violated: Avoid methods too big, too complex |

• How to Fix Issues: A large and complex method should be split in smaller methods, or even one or several classes can be created for that. During this process it is important to question the scope of each variable local to the method. This can be an indication if such local variable will become an instance field of the newly created class(es). Large switch…case structures might be refactored through the help of a set of types that implement a common interface, the interface polymorphism playing the role of the switch cases tests. Unit Tests can help: write tests for each method before extracting it to ensure you don't break functionality. The estimated Debt, which means the effort to fix such issue, varies from 40 minutes to 8 hours, linearly from a weighted complexity score.

311 methods matched

- The following list of methods is truncated and contains only the first 100 methods of the 311 methods matched.

-

Formatting: bold means added, underlined means code was changed,

strike-boldmeans removed (since baseline)

| 311 methods | # lines of code (LOC) | Cyclomatic Complexity (CC) | complexityScore | Debt | Annual Interest | Full Name |

|---|---|---|---|---|---|---|

| applyTo(QuantLib::Array&,Time) | 4 294 967 295 | 2 | 2 147 483 649 | 1d 0h | 40min | QuantLib.FdmStepConditionComposite .applyTo(QuantLib::Array&,Time) |

| createSmileSections() | 3 002 | 1 | 1 502 | 1d 0h | 40min | anonymous_namespace{rangeaccrual.cpp} .CommonVars.createSmileSections() |

| isBusinessDay(constQuantLib::Date&) | 7 | 1 104 | 1 107 | 1d 0h | 40min | QuantLib.Israel+TelAvivImpl .isBusinessDay(constQuantLib::Date&) |

| isBusinessDay(constQuantLib::Date&) | 7 | 431 | 434 | 1d 0h | 40min | QuantLib.SouthKorea+SettlementImpl .isBusinessDay(constQuantLib::Date&) |

| testRussia() | 573 | 2 | 288 | 5h 46min | 40min | CalendarTest.testRussia() |

| testPathwiseVegas() | 381 | 95 | 285 | 5h 43min | 40min | MarketModelTest.testPathwiseVegas() |

| isBusinessDay(constQuantLib::Date&) | 7 | 266 | 269 | 5h 24min | 40min | QuantLib.China+SseImpl.isBusinessDay (constQuantLib::Date&) |

| isBusinessDay(constQuantLib::Date&) | 39 | 213 | 232 | 4h 40min | 40min | QuantLib.Indonesia+BejImpl.isBusinessDay (constQuantLib::Date&) |

| isBusinessDay(constQuantLib::Date&) | 39 | 205 | 224 | 4h 30min | 40min | QuantLib.India+NseImpl.isBusinessDay (constQuantLib::Date&) |

| isBusinessDay(constQuantLib::Date&) | 44 | 196 | 218 | 4h 23min | 40min | QuantLib.HongKong+HkexImpl.isBusinessDay (constQuantLib::Date&) |

| SVD(constQuantLib::Matrix&) | 233 | 82 | 198 | 3h 59min | 39min | QuantLib.SVD.SVD(constQuantLib::Matrix&) |

| isBusinessDay(constQuantLib::Date&) | 8 | 179 | 183 | 3h 41min | 36min | QuantLib.Singapore+SgxImpl.isBusinessDay (constQuantLib::Date&) |

| isBusinessDay(constQuantLib::Date&) | 46 | 159 | 182 | 3h 40min | 35min | QuantLib.Taiwan+TsecImpl.isBusinessDay (constQuantLib::Date&) |

| testPathwiseMarketVegas() | 218 | 56 | 165 | 3h 20min | 32min | MarketModelTest.testPathwiseMarketVegas( ) |

| SobolRsg(Size,unsignedlong ,QuantLib::SobolRsg::DirectionIntegers) | 152 | 52 | 128 | 2h 36min | 23min | QuantLib.SobolRsg.SobolRsg(Size ,unsignedlong ,QuantLib::SobolRsg::DirectionIntegers) |

| isBusinessDay(constQuantLib::Date&) | 14 | 114 | 121 | 2h 28min | 22min | QuantLib.Japan+Impl.isBusinessDay (constQuantLib::Date&) |

| setCapFloorTermVolSurface() | 241 | 1 | 121 | 2h 28min | 22min | anonymous_namespace{optionletstripper .cpp}.CommonVars .setCapFloorTermVolSurface() |

| isBusinessDay(constQuantLib::Date&) | 40 | 98 | 118 | 2h 24min | 21min | QuantLib.Turkey+Impl.isBusinessDay (constQuantLib::Date&) |

| main(int,char**) | 209 | 6 | 110 | 2h 15min | 19min | __Globals.main(int,char**) |

| isBusinessDay(constQuantLib::Date&) | 14 | 98 | 105 | 2h 9min | 18min | QuantLib.UnitedStates+NyseImpl .isBusinessDay(constQuantLib::Date&) |

| testSpecializedBondVsGenericBondUsingAsw () | 166 | 17 | 100 | 2h 3min | 17min | AssetSwapTest .testSpecializedBondVsGenericBondUsingAs w() |

| lmpar(int,Real*,int,int*,Real*,Real* ,Real,Real*,Real*,Real*,Real*,Real*) | 115 | 39 | 96 | 1h 58min | 16min | QuantLib.MINPACK.__Globals.lmpar(int ,Real*,int,int*,Real*,Real*,Real,Real* ,Real*,Real*,Real*,Real*) |

| npvs(constQuantLib::Date&,constReal ,constbool,constbool) | 109 | 38 | 92 | 1h 53min | 15min | QuantLib .Gaussian1dFloatFloatSwaptionEngine.npvs (constQuantLib::Date&,constReal ,constbool,constbool) |

| testVPPPricing() | 123 | 31 | 92 | 1h 53min | 15min | VPPTest.testVPPPricing() |

| singlePathValues(std::vector<Real>&) | 103 | 40 | 91 | 1h 52min | 15min | QuantLib .PathwiseVegasOuterAccountingEngine .singlePathValues(std::vector<Real>&) |

| singlePathValues(std::vector<Real>&) | 101 | 39 | 89 | 1h 50min | 15min | QuantLib.PathwiseVegasAccountingEngine .singlePathValues(std::vector<Real>&) |

| calculate() | 145 | 15 | 87 | 1h 47min | 14min | QuantLib.AnalyticGJRGARCHEngine .calculate() |

| hypersphereOptimize (constQuantLib::Matrix& ,constQuantLib::Matrix&,constbool) | 88 | 41 | 85 | 1h 45min | 14min | QuantLib.anonymous_namespace{pseudosqrt .cpp}.__Globals.hypersphereOptimize (constQuantLib::Matrix& ,constQuantLib::Matrix&,constbool) |

| main(int,char**) | 131 | 20 | 85 | 1h 45min | 14min | __Globals.main(int,char**) |

| main(int,char**) | 157 | 5 | 83 | 1h 43min | 13min | __Globals.main(int,char**) |

| payoffAtExpiry(Real,Real,Real) | 107 | 26 | 79 | 1h 38min | 12min | QuantLib .AnalyticBinaryBarrierEngine_helper .payoffAtExpiry(Real,Real,Real) |

| intersect() | 109 | 25 | 79 | 1h 38min | 12min | QuantLib .InterpolatedYoYCapFloorTermPriceSurface <Interpolator2D,Interpolator1D> .intersect() |

| singleRateClosestPointFinder(Size ,conststd::vector<Volatility>& ,conststd::vector<Volatility>&,Real ,conststd::vector<Real>&,Real,Real,Real ,Size,Real,std::vector<Volatility>&,Real ,Real&,Real&) | 114 | 20 | 77 | 1h 35min | 12min | QuantLib .anonymous_namespace{capletcoterminalmax homogeneity.cpp}.__Globals .singleRateClosestPointFinder(Size ,conststd::vector<Volatility>& ,conststd::vector<Volatility>&,Real ,conststd::vector<Real>&,Real,Real,Real ,Size,Real,std::vector<Volatility>&,Real ,Real&,Real&) |

| SmileSectionUtils (constQuantLib::SmileSection& ,conststd::vector<Real>&,constReal ,constbool) | 83 | 34 | 75 | 1h 33min | 12min | QuantLib.SmileSectionUtils .SmileSectionUtils (constQuantLib::SmileSection& ,conststd::vector<Real>&,constReal ,constbool) |

| singlePathValues(std::vector<Real>&) | 85 | 32 | 74 | 1h 32min | 11min | QuantLib.PathwiseAccountingEngine .singlePathValues(std::vector<Real>&) |

| testKernelInterpolation2D() | 127 | 10 | 73 | 1h 31min | 11min | InterpolationTest .testKernelInterpolation2D() |

| createVolatilityStructures() | 128 | 8 | 72 | 1h 29min | 11min | anonymous_namespace{rangeaccrual.cpp} .CommonVars.createVolatilityStructures() |

| testSpecializedBondVsGenericBond() | 108 | 17 | 71 | 1h 28min | 11min | AssetSwapTest .testSpecializedBondVsGenericBond() |

| testHW(unsignedint) | 112 | 14 | 70 | 1h 27min | 10min | CdoTest.testHW(unsignedint) |

| InverseFloater(Real) | 120 | 10 | 70 | 1h 27min | 10min | __Globals.InverseFloater(Real) |

| Bermudan() | 116 | 10 | 68 | 1h 25min | 10min | __Globals.Bermudan() |

| calculate() | 78 | 28 | 67 | 1h 24min | 10min | QuantLib .Gaussian1dNonstandardSwaptionEngine .calculate() |

| ND2(Real,Real,Real) | 102 | 16 | 67 | 1h 24min | 10min | QuantLib .anonymous_namespace{perturbativebarrier optionengine.cpp}.__Globals.ND2(Real ,Real,Real) |

| SymmetricSchurDecomposition (constQuantLib::Matrix&) | 81 | 26 | 66 | 1h 22min | 10min | QuantLib.SymmetricSchurDecomposition .SymmetricSchurDecomposition (constQuantLib::Matrix&) |

| operator()(constQuantLib::Path&) | 84 | 24 | 66 | 1h 22min | 10min | QuantLib.BarrierPathPricer.operator() (constQuantLib::Path&) |

| testSabrInterpolation() | 108 | 12 | 66 | 1h 22min | 10min | InterpolationTest.testSabrInterpolation( ) |

| testNoArbSabrInterpolation() | 109 | 12 | 66 | 1h 22min | 10min | InterpolationTest .testNoArbSabrInterpolation() |

| CommonVars() | 121 | 5 | 65 | 1h 21min | 9min | anonymous_namespace{cms.cpp}.CommonVars .CommonVars() |

| calculate() | 72 | 28 | 64 | 1h 20min | 9min | QuantLib.Gaussian1dSwaptionEngine .calculate() |

| testPathwiseGreeks() | 85 | 22 | 64 | 1h 20min | 9min | MarketModelTest.testPathwiseGreeks() |

| BarrierUPD(Real,Real,Real,Real,Real,int ,int,int,int,int,int,int) | 110 | 9 | 64 | 1h 20min | 9min | QuantLib .anonymous_namespace{perturbativebarrier optionengine.cpp}.__Globals.BarrierUPD (Real,Real,Real,Real,Real,int,int,int ,int,int,int,int) |

| main(int,char**) | 76 | 24 | 62 | 1h 18min | 9min | __Globals.main(int,char**) |

| main(int,char**) | 106 | 9 | 62 | 1h 18min | 9min | __Globals.main(int,char**) |

| qrsolv(int,Real*,int,int*,Real*,Real* ,Real*,Real*,Real*) | 76 | 23 | 61 | 1h 16min | 8min | QuantLib.MINPACK.__Globals.qrsolv(int ,Real*,int,int*,Real*,Real*,Real*,Real* ,Real*) |

| collectNodeData (QuantLib::MarketModelEvolver& ,QuantLib::MarketModelMultiProduct& ,QuantLib::MarketModelNodeDataProvider& ,QuantLib::MarketModelExerciseValue& ,QuantLib::MarketModelExerciseValue& ,Size,std::vector<std::vector<NodeData> >&) | 89 | 17 | 61 | 1h 16min | 8min | QuantLib.__Globals.collectNodeData (QuantLib::MarketModelEvolver& ,QuantLib::MarketModelMultiProduct& ,QuantLib::MarketModelNodeDataProvider& ,QuantLib::MarketModelExerciseValue& ,QuantLib::MarketModelExerciseValue& ,Size,std::vector<std::vector<NodeData> >&) |

| compute() | 89 | 17 | 61 | 1h 16min | 8min | QuantLib.KahaleSmileSection.compute() |

| testResults() | 92 | 15 | 61 | 1h 16min | 8min | RiskStatisticsTest.testResults() |

| qrfac(int,int,Real*,int,int,int*,int ,Real*,Real*,Real*) | 77 | 22 | 60 | 1h 15min | 8min | QuantLib.MINPACK.__Globals.qrfac(int,int ,Real*,int,int,int*,int,Real*,Real* ,Real*) |

| evolve(Time,constQuantLib::Array&,Time ,constQuantLib::Array&) | 80 | 18 | 58 | 1h 13min | 8min | QuantLib.HestonProcess.evolve(Time ,constQuantLib::Array&,Time ,constQuantLib::Array&) |

| isExtraHoliday(Day,QuantLib::Month,Year) | 45 | 35 | 57 | 1h 12min | 8min | QuantLib.anonymous_namespace{russia.cpp} .__Globals.isExtraHoliday(Day ,QuantLib::Month,Year) |

| compute() | 71 | 22 | 57 | 1h 12min | 8min | QuantLib.CreditRiskPlus.compute() |

| testEngines() | 102 | 6 | 57 | 1h 12min | 8min | GJRGARCHModelTest.testEngines() |

| operator+=(constQuantLib::Period&) | 64 | 24 | 56 | 1h 10min | 7min | QuantLib.Period.operator+= (constQuantLib::Period&) |

| TqrEigenDecomposition (constQuantLib::Array& ,constQuantLib::Array& ,QuantLib::TqrEigenDecomposition::EigenV ectorCalculation ,QuantLib::TqrEigenDecomposition::ShiftS trategy) | 66 | 23 | 56 | 1h 10min | 7min | QuantLib.TqrEigenDecomposition .TqrEigenDecomposition (constQuantLib::Array& ,constQuantLib::Array& ,QuantLib::TqrEigenDecomposition::EigenV ectorCalculation ,QuantLib::TqrEigenDecomposition::ShiftS trategy) |

| calculateNextGeneration(std::vector <Candidate>& ,constQuantLib::CostFunction&) | 70 | 21 | 56 | 1h 10min | 7min | QuantLib.DifferentialEvolution .calculateNextGeneration(std::vector <Candidate>& ,constQuantLib::CostFunction&) |

| minimize(QuantLib::Problem& ,constQuantLib::EndCriteria&) | 71 | 21 | 56 | 1h 10min | 7min | QuantLib.Simplex.minimize (QuantLib::Problem& ,constQuantLib::EndCriteria&) |

| main(int,char**) | 96 | 8 | 56 | 1h 10min | 7min | __Globals.main(int,char**) |

| isBusinessDay(constQuantLib::Date&) | 8 | 51 | 55 | 1h 9min | 7min | QuantLib.SouthAfrica+Impl.isBusinessDay (constQuantLib::Date&) |

| hestonFokkerPlanckFwdEquationTest(const (anonymousnamespace )::FokkerPlanckFwdTestCase&) | 87 | 12 | 55 | 1h 9min | 7min | anonymous_namespace{hestonslvmodel.cpp} .__Globals .hestonFokkerPlanckFwdEquationTest(const (anonymousnamespace )::FokkerPlanckFwdTestCase&) |

| testGenericBondImplied() | 91 | 10 | 55 | 1h 9min | 7min | AssetSwapTest.testGenericBondImplied() |

| main(int,char**) | 88 | 10 | 54 | 1h 8min | 7min | __Globals.main(int,char**) |

| main(int,char**) | 94 | 7 | 54 | 1h 8min | 7min | __Globals.main(int,char**) |

| operator()(constQuantLib::Path&) | 58 | 24 | 53 | 1h 7min | 7min | QuantLib.BiasedBarrierPathPricer .operator()(constQuantLib::Path&) |

| performCalculations() | 72 | 17 | 53 | 1h 7min | 7min | __Globals.performCalculations() |

| testZeroTermStructure() | 78 | 13 | 52 | 1h 6min | 6min | InflationTest.testZeroTermStructure() |

| main(int,char**) | 87 | 9 | 52 | 1h 6min | 6min | __Globals.main(int,char**) |

| testMASWWithGenericBond() | 103 | 1 | 52 | 1h 6min | 6min | AssetSwapTest.testMASWWithGenericBond() |

| testKernelInterpolation() | 86 | 8 | 51 | 1h 4min | 6min | InterpolationTest .testKernelInterpolation() |

| isBusinessDay(constQuantLib::Date&) | 8 | 46 | 50 | 1h 3min | 6min | QuantLib.Canada+SettlementImpl .isBusinessDay(constQuantLib::Date&) |

| initialGuess1(constQuantLib::Array&,Real ,Real&,Real&,Real&) | 62 | 19 | 50 | 1h 3min | 6min | QuantLib.anonymous_namespace{garch.cpp} .__Globals.initialGuess1 (constQuantLib::Array&,Real,Real&,Real& ,Real&) |

| testZSpreadWithGenericBond() | 82 | 9 | 50 | 1h 3min | 6min | AssetSwapTest.testZSpreadWithGenericBond () |

| testCalibration() | 53 | 23 | 49 | 1h 2min | 6min | GARCHTest.testCalibration() |

| updateNumeraireTabulation() | 63 | 18 | 49 | 1h 2min | 6min | QuantLib.MarkovFunctional .updateNumeraireTabulation() |

| performCalculations() | 65 | 17 | 49 | 1h 2min | 6min | QuantLib.HestonSLVFDMModel .performCalculations() |

| isBusinessDay(constQuantLib::Date&) | 8 | 44 | 48 | 1h 1min | 6min | QuantLib.UnitedKingdom+SettlementImpl .isBusinessDay(constQuantLib::Date&) |

| isBusinessDay(constQuantLib::Date&) | 8 | 44 | 48 | 1h 1min | 6min | QuantLib.UnitedKingdom+ExchangeImpl .isBusinessDay(constQuantLib::Date&) |

| isBusinessDay(constQuantLib::Date&) | 8 | 44 | 48 | 1h 1min | 6min | QuantLib.UnitedKingdom+MetalsImpl .isBusinessDay(constQuantLib::Date&) |

| testGreeks() | 73 | 12 | 48 | 1h 1min | 6min | MarketModelTest.testGreeks() |

| testMarketASWSpread() | 79 | 9 | 48 | 1h 1min | 6min | AssetSwapTest.testMarketASWSpread() |

| main(int,char**) | 81 | 8 | 48 | 1h 1min | 6min | __Globals.main(int,char**) |

| createYieldCurve() | 94 | 1 | 48 | 1h 1min | 6min | anonymous_namespace{rangeaccrual.cpp} .CommonVars.createYieldCurve() |

| performCalculations() | 58 | 18 | 47 | 1h 0min | 5min | __Globals.performCalculations() |

| setup() | 93 | 1 | 47 | 1h 0min | 5min | anonymous_namespace{matrices.cpp} .__Globals.setup() |

| calculate() | 71 | 11 | 46 | 59min | 5min | QuantLib .ContinuousArithmeticAsianVecerEngine .calculate() |

| BVTL(int,Real,Real,Real) | 73 | 10 | 46 | 59min | 5min | QuantLib .anonymous_namespace{perturbativebarrier optionengine.cpp}.__Globals.BVTL(int ,Real,Real,Real) |

| isBusinessDay(constQuantLib::Date&) | 8 | 41 | 45 | 57min | 5min | QuantLib.Canada+TsxImpl.isBusinessDay (constQuantLib::Date&) |

| checkBarrier(QuantLib::Array& ,constQuantLib::Array&) | 47 | 22 | 45 | 57min | 5min | QuantLib.DiscretizedDoubleBarrierOption .checkBarrier(QuantLib::Array& ,constQuantLib::Array&) |

| P_n(Real,Real,Natural,Real) | 72 | 9 | 45 | 57min | 5min | QuantLib .anonymous_namespace{bivariatestudenttdi stribution.cpp}.__Globals.P_n(Real,Real ,Natural,Real) |

| main(int,char**) | 76 | 7 | 45 | 57min | 5min | __Globals.main(int,char**) |

| testCachedMarketValue() | 87 | 2 | 45 | 57min | 5min | CreditDefaultSwapTest .testCachedMarketValue() |

| Critical Rule Violated: Avoid methods with too many parameters |

• How to Fix Issues: More properties/fields can be added to the declaring type to handle numerous states. An alternative is to provide a class or a structure dedicated to handle arguments passing. The estimated Debt, which means the effort to fix such issue, varies linearly from 1 hour for a method with 7 parameters, up to 6 hours for a methods with 40 or more parameters.

181 methods matched

- The following list of methods is truncated and contains only the first 100 methods of the 181 methods matched.

-

Formatting: bold means added, underlined means code was changed,

strike-boldmeans removed (since baseline)

| 181 methods | # Parameters | Debt | Annual Interest | Full Name |

|---|---|---|---|---|

| FixedRateBond(Natural ,constQuantLib::Calendar&,Real ,constQuantLib::Date& ,constQuantLib::Date& ,constQuantLib::Period&,conststd::vector <Rate>&,constQuantLib::DayCounter& ,QuantLib::BusinessDayConvention ,QuantLib::BusinessDayConvention,Real ,constQuantLib::Date& ,constQuantLib::Date& ,DateGeneration::Rule,bool ,constQuantLib::Calendar& ,constQuantLib::Period& ,constQuantLib::Calendar& ,constQuantLib::BusinessDayConvention ,bool) | 20 | 2h 58min | 48min | QuantLib.FixedRateBond.FixedRateBond (Natural,constQuantLib::Calendar&,Real ,constQuantLib::Date& ,constQuantLib::Date& ,constQuantLib::Period&,conststd::vector <Rate>&,constQuantLib::DayCounter& ,QuantLib::BusinessDayConvention ,QuantLib::BusinessDayConvention,Real ,constQuantLib::Date& ,constQuantLib::Date& ,DateGeneration::Rule,bool ,constQuantLib::Calendar& ,constQuantLib::Period& ,constQuantLib::Calendar& ,constQuantLib::BusinessDayConvention ,bool) |

| SviInterpolatedSmileSection (constQuantLib::Date&,constHandle <QuantLib::Quote>&,conststd::vector<Rate >&,bool,constHandle<QuantLib::Quote>& ,conststd::vector<Handle<Quote>>&,Real ,Real,Real,Real,Real,bool,bool,bool,bool ,bool,bool,constint) | 18 | 2h 40min | 41min | QuantLib.SviInterpolatedSmileSection .SviInterpolatedSmileSection (constQuantLib::Date&,constHandle <QuantLib::Quote>&,conststd::vector<Rate >&,bool,constHandle<QuantLib::Quote>& ,conststd::vector<Handle<Quote>>&,Real ,Real,Real,Real,Real,bool,bool,bool,bool ,bool,bool,constint) |

| GemanRoncoroniProcess(Real,Real,Real ,Real,Real,Real,Real,Real,Real,Real,Real ,Real,Real,Real,Real,Real,Real) | 17 | 2h 30min | 37min | QuantLib.GemanRoncoroniProcess .GemanRoncoroniProcess(Real,Real,Real ,Real,Real,Real,Real,Real,Real,Real,Real ,Real,Real,Real,Real,Real,Real) |

| solve(Real,Integer,conststd::vector <Volatility>&,conststd::vector <Volatility>&,conststd::vector<Real>& ,Real,Real,Real,Real,Real,Real,Integer ,Real&,Real&,Real&,std::vector <Volatility>&) | 16 | 2h 21min | 34min | QuantLib.AlphaFinder.solve(Real,Integer ,conststd::vector<Volatility>& ,conststd::vector<Volatility>& ,conststd::vector<Real>&,Real,Real,Real ,Real,Real,Real,Integer,Real&,Real& ,Real&,std::vector<Volatility>&) |

| solveWithMaxHomogeneity(Real,Integer ,conststd::vector<Volatility>& ,conststd::vector<Volatility>& ,conststd::vector<Real>&,Real,Real,Real ,Real,Real,Real,Integer,Real&,Real& ,Real&,std::vector<Volatility>&) | 16 | 2h 21min | 34min | QuantLib.AlphaFinder .solveWithMaxHomogeneity(Real,Integer ,conststd::vector<Volatility>& ,conststd::vector<Volatility>& ,conststd::vector<Real>&,Real,Real,Real ,Real,Real,Real,Integer,Real&,Real& ,Real&,std::vector<Volatility>&) |

| SabrInterpolatedSmileSection (constQuantLib::Date&,constHandle <QuantLib::Quote>&,conststd::vector<Rate >&,bool,constHandle<QuantLib::Quote>& ,conststd::vector<Handle<Quote>>&,Real ,Real,Real,Real,bool,bool,bool,bool,bool ,constint) | 16 | 2h 21min | 34min | QuantLib.SabrInterpolatedSmileSection .SabrInterpolatedSmileSection (constQuantLib::Date&,constHandle <QuantLib::Quote>&,conststd::vector<Rate >&,bool,constHandle<QuantLib::Quote>& ,conststd::vector<Handle<Quote>>&,Real ,Real,Real,Real,bool,bool,bool,bool,bool ,constint) |

| doCalculation(Real,Real,Real,Real,Real ,Real,Real,Real,Real,Real ,constQuantLib::TypePayoff& ,constQuantLib::AnalyticHestonEngine::In tegration& ,constQuantLib::AnalyticHestonEngine::Co mplexLogFormula ,constQuantLib::AnalyticHestonEngine*con st,Real&,Size&) | 16 | 2h 21min | 34min | QuantLib.AnalyticHestonEngine .doCalculation(Real,Real,Real,Real,Real ,Real,Real,Real,Real,Real ,constQuantLib::TypePayoff& ,constQuantLib::AnalyticHestonEngine::In tegration& ,constQuantLib::AnalyticHestonEngine::Co mplexLogFormula ,constQuantLib::AnalyticHestonEngine*con st,Real&,Size&) |

| NoArbSabrInterpolatedSmileSection (constQuantLib::Date&,constHandle <QuantLib::Quote>&,conststd::vector<Rate >&,bool,constHandle<QuantLib::Quote>& ,conststd::vector<Handle<Quote>>&,Real ,Real,Real,Real,bool,bool,bool,bool,bool ,constint) | 16 | 2h 21min | 34min | QuantLib .NoArbSabrInterpolatedSmileSection .NoArbSabrInterpolatedSmileSection (constQuantLib::Date&,constHandle <QuantLib::Quote>&,conststd::vector<Rate >&,bool,constHandle<QuantLib::Quote>& ,conststd::vector<Handle<Quote>>&,Real ,Real,Real,Real,bool,bool,bool,bool,bool ,constint) |

| FixedRateBondHelper(constHandle <QuantLib::Quote>&,Natural,Real ,constQuantLib::Schedule& ,conststd::vector<Rate>& ,constQuantLib::DayCounter& ,QuantLib::BusinessDayConvention,Real ,constQuantLib::Date& ,constQuantLib::Calendar& ,constQuantLib::Period& ,constQuantLib::Calendar& ,constQuantLib::BusinessDayConvention ,bool,constbool) | 15 | 2h 12min | 30min | QuantLib.FixedRateBondHelper .FixedRateBondHelper(constHandle <QuantLib::Quote>&,Natural,Real ,constQuantLib::Schedule& ,conststd::vector<Rate>& ,constQuantLib::DayCounter& ,QuantLib::BusinessDayConvention,Real ,constQuantLib::Date& ,constQuantLib::Calendar& ,constQuantLib::Period& ,constQuantLib::Calendar& ,constQuantLib::BusinessDayConvention ,bool,constbool) |

| InterpolatedCPICapFloorTermPriceSurface <Interpolator2D>(Real,Rate ,constQuantLib::Period& ,constQuantLib::Calendar& ,constQuantLib::BusinessDayConvention& ,constQuantLib::DayCounter&,constHandle <QuantLib::ZeroInflationIndex>& ,constHandle <QuantLib::YieldTermStructure>& ,conststd::vector<Rate>& ,conststd::vector<Rate>& ,conststd::vector<Period>& ,constQuantLib::Matrix& ,constQuantLib::Matrix& ,constInterpolator2D&) | 14 | 2h 3min | 27min | QuantLib .InterpolatedCPICapFloorTermPriceSurface <Interpolator2D> .InterpolatedCPICapFloorTermPriceSurface <Interpolator2D>(Real,Rate ,constQuantLib::Period& ,constQuantLib::Calendar& ,constQuantLib::BusinessDayConvention& ,constQuantLib::DayCounter&,constHandle <QuantLib::ZeroInflationIndex>& ,constHandle <QuantLib::YieldTermStructure>& ,conststd::vector<Rate>& ,conststd::vector<Rate>& ,conststd::vector<Period>& ,constQuantLib::Matrix& ,constQuantLib::Matrix& ,constInterpolator2D&) |

| UpfrontCdsHelper(constHandle <QuantLib::Quote>&,Rate ,constQuantLib::Period&,Integer ,constQuantLib::Calendar& ,QuantLib::Frequency ,QuantLib::BusinessDayConvention ,DateGeneration::Rule ,constQuantLib::DayCounter&,Real ,constHandle <QuantLib::YieldTermStructure>&,Natural ,bool,bool) | 14 | 2h 3min | 27min | QuantLib.UpfrontCdsHelper .UpfrontCdsHelper(constHandle <QuantLib::Quote>&,Rate ,constQuantLib::Period&,Integer ,constQuantLib::Calendar& ,QuantLib::Frequency ,QuantLib::BusinessDayConvention ,DateGeneration::Rule ,constQuantLib::DayCounter&,Real ,constHandle <QuantLib::YieldTermStructure>&,Natural ,bool,bool) |

| UpfrontCdsHelper(Rate,Rate ,constQuantLib::Period&,Integer ,constQuantLib::Calendar& ,QuantLib::Frequency ,QuantLib::BusinessDayConvention ,DateGeneration::Rule ,constQuantLib::DayCounter&,Real ,constHandle <QuantLib::YieldTermStructure>&,Natural ,bool,bool) | 14 | 2h 3min | 27min | QuantLib.UpfrontCdsHelper .UpfrontCdsHelper(Rate,Rate ,constQuantLib::Period&,Integer ,constQuantLib::Calendar& ,QuantLib::Frequency ,QuantLib::BusinessDayConvention ,DateGeneration::Rule ,constQuantLib::DayCounter&,Real ,constHandle <QuantLib::YieldTermStructure>&,Natural ,bool,bool) |

| CDO(Real,Real,conststd::vector<Real>& ,conststd::vector<Handle <DefaultProbabilityTermStructure>>& ,constHandle<QuantLib::OneFactorCopula>& ,bool,constQuantLib::Schedule&,Rate ,constQuantLib::DayCounter&,Rate,Rate ,constHandle <QuantLib::YieldTermStructure>&,Size ,constQuantLib::Period&) | 14 | 2h 3min | 27min | QuantLib.CDO.CDO(Real,Real ,conststd::vector<Real>& ,conststd::vector<Handle <DefaultProbabilityTermStructure>>& ,constHandle<QuantLib::OneFactorCopula>& ,bool,constQuantLib::Schedule&,Rate ,constQuantLib::DayCounter&,Rate,Rate ,constHandle <QuantLib::YieldTermStructure>&,Size ,constQuantLib::Period&) |

| singleRateClosestPointFinder(Size ,conststd::vector<Volatility>& ,conststd::vector<Volatility>&,Real ,conststd::vector<Real>&,Real,Real,Real ,Size,Real,std::vector<Volatility>&,Real ,Real&,Real&) | 14 | 2h 3min | 27min | QuantLib .anonymous_namespace{capletcoterminalmax homogeneity.cpp}.__Globals .singleRateClosestPointFinder(Size ,conststd::vector<Volatility>& ,conststd::vector<Volatility>&,Real ,conststd::vector<Real>&,Real,Real,Real ,Size,Real,std::vector<Volatility>&,Real ,Real&,Real&) |